(extraordinary report based on the parliamentary debate on the Government Manifesto and a vote of confidence in the government of 4 May 2021)

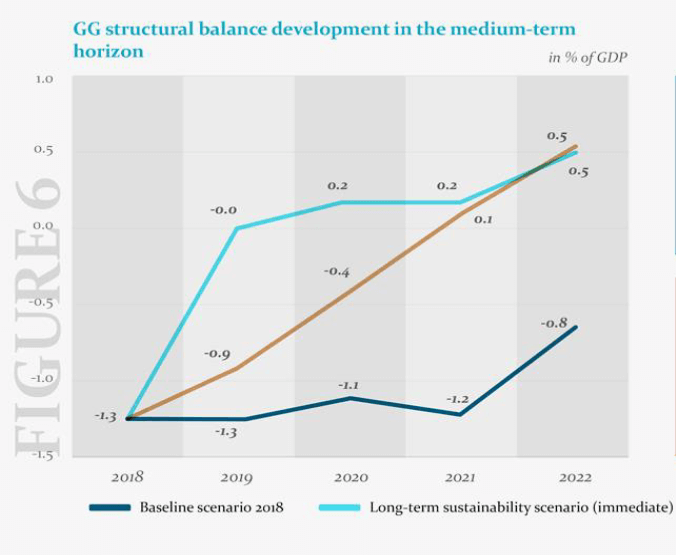

The Council notes that, in May 2021, public finances were not sustainable in the long term. The long-term sustainability indicator at the level of 6.1% of GDP (EUR 6.3bn) was in the high-risk zone, which means that in order to keep the general government gross debt below the upper debt ceiling (50% of GDP) over the next fifty years, the public finance deficit would need to be improved by the same amount.

The preliminary deficit estimates for this year started deteriorating, according to the Budget Traffic Lights, from 6.8% of GDP in March to 7.7% of GDP in May. Compared to the sustainability evaluation for 2020, the long-term sustainability indicator worsened by 0.5% of GDP based on the most recent information. It means that the budgetary policy has improved the long-term sustainability by mere 0.6% of GDP since the election. This development is mainly driven by the changes in the 2021 budget which takes into account new legislative measures (introduction of the contribution for kurzarbeit, new subsidies in the area of family support, provision of subsidies to support housing development and in the area of sport support, free bus transport planned in the budget to be introduced from this year), as well as non-legislative measures (current development in expenditure compared to the assumptions contained in the baseline scenario) of the government, resulting in a worse public finance development than expected under a no-policy-change scenario.

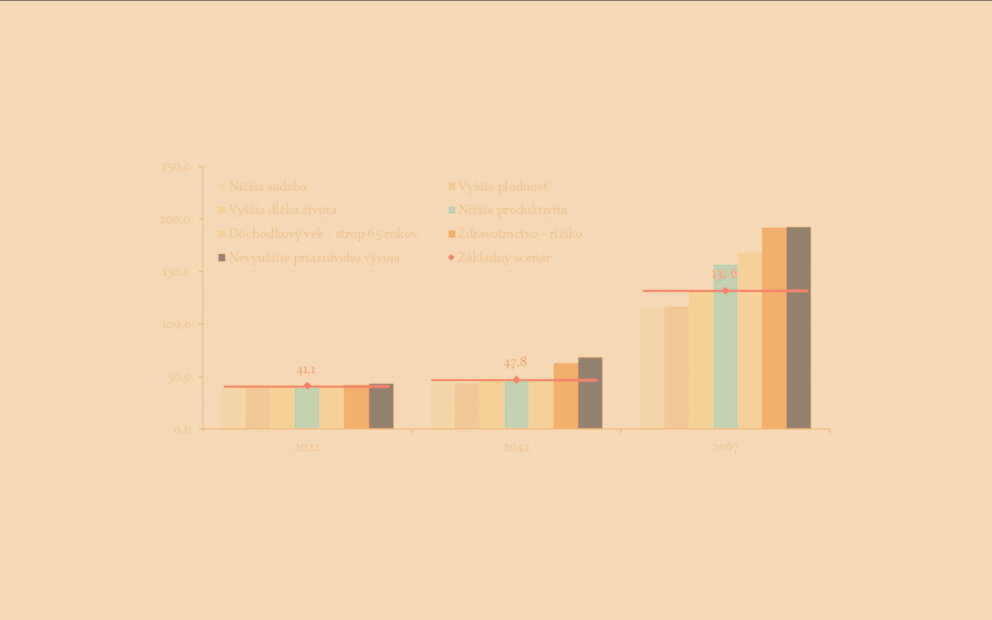

If the present policies are preserved, population ageing will increase expenditures sensitive to demographic changes to as much as 5.6% of GDP. The debt would remain permanently above the upper threshold of the debt limit and would continue to rise rapidly to unsustainable heights: the 100% of GDP mark would be exceeded in 2039, the 150% of GDP mark in 2047, and the 200% of GDP mark in 2053. On top of that, the calculation already incorporates the passive, no-policy-change (NPC) scenario which automatically decreases the deficit from the estimated level of 7.7% of GDP in 2021 to 3.7% of GDP in 2024. In order to improve the long-term sustainability in the absence of other measures with long-term effects (such as, for example, a pension reform), it would be necessary to keep deficits below this adjustment path assumed under the NPC scenario. Unfortunately, the approved Stability Programme has no such ambition.

In order to essentially curb the long-term sustainability risks down to the low-risk zone, a structural surplus of as much as 2.1% of GDP would need to be achieved in the medium term. A lower surplus could be sufficient if other measures with long-term effects were adopted too, ones which would enhance the sustainability through a responsible countercyclical fiscal policy and improve the revenue-expenditure balance in future, mainly in the pensions system, healthcare and long-term care sectors on the expenditure side, and by structural reforms with a positive impact on the economic potential on the revenue side. Any delays in the adoption of expenditure ceilings and pension system reform with a considerably positive impact on the system’s sustainability may thus translate into more extensive consolidation efforts necessary in the future to restore the stability of public finances.y of public finances.