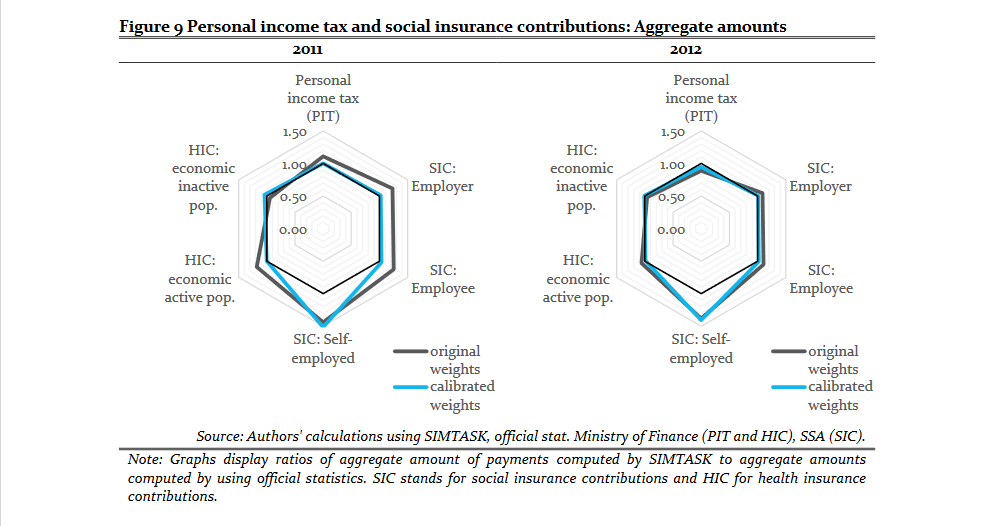

Fundamental income tax reforms are usually justified by or opposed because of large employment implications. The employment gains and losses are supposed to originate from various behavioural and dynamic effects of tax reforms over the medium to long term.