The 2013-2015 General Government Budget Proposal was prepared in a turbulent economic situation. The ongoing economic crisis in the eurozone, connected with the loss of confidence on financial markets, prompts the adoption of non-standard decisions also in the area of public finances.

Despite the subsiding economic activity, many countries need to adopt restrictive measures in order to maintain their ability to re-finance their debts through financial markets without having to resort to various emergency mechanisms. In this situation, it is essential for Slovakia to stay among the countries which have a solid reputation on financial markets.

Against the backdrop of the adverse external environment, the Council highly appreciates the fact that the budget proposal clearly sticks to the key objective for 2013: reducing the general government deficit below 3% percent of GDP. Apart from Slovakia’s credibility, also at stake is a potential sanction for non-compliance under the revised Stability and Growth Pact and other related regulations amounting to 0.2% of GDP (about €140m).

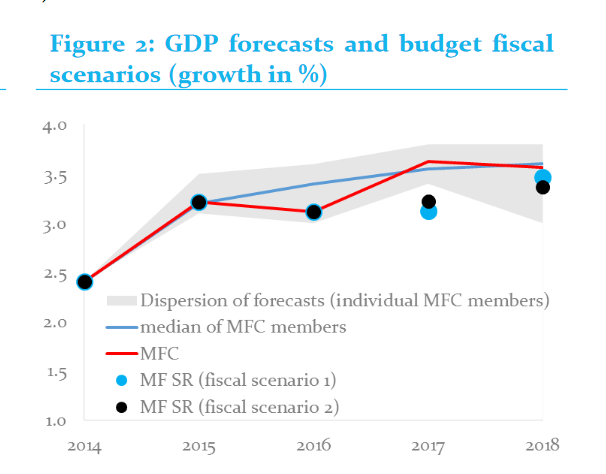

The macroeconomic assumptions contained in the budget proposal were, at the time they were made, evaluated by the Macroeconomic Forecasting Committee as being realistic. However, given the adverse development in the corporate sector’s expectations and the unremittingly downward revisions of growth projections by international institutions, the CBR still senses discernible negative risks which may amplify the impact of the uncertainty on financial markets on the real economy indicators.

The tax-revenue estimates used in the budget are on the cautious end, taking also into account the impact of potential changes in the behaviour of those affected (dynamic effects). However, as the budget proposal states, a large number of legislative changes in this area and their combined impact are difficult to assess and they thus represent a risk of the forecast. The increase in the tax burden is bound to induce significant dynamic effects, particularly when it comes to the self-employed, casual workers and legal persons, as they will seek to minimize the impact of the increased burden of taxation and social contributions.

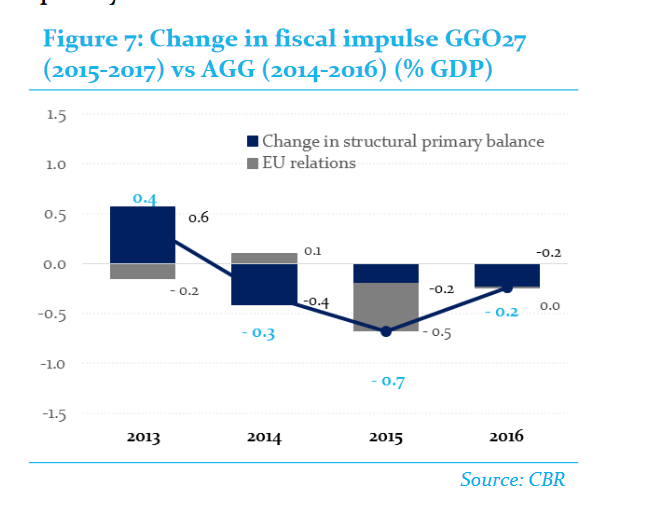

The measures designed to meet the objectives are well defined – as in previous years – only for 2013, with consolidation focusing primarily on the revenue side. The exact proportion of the revenue and expenditure measures depends on the extent to which the reserves, set aside in the budget to cover unexpected expenditures, will be used. The consolidation effort, which evaluates permanent deficit reduction from a short-term perspective, has been set at 1.3% of GDP for 2013.

In addition to the considerable uncertainties in the macroeconomic environment and the dynamic effects of consolidation measures, the Council for Budget Responsibility sees risks in a number of areas. The budgets of municipalities and self-governing regions rank first on the list of those risks. Neither municipalities nor self-governing regions are likely to reduce their expenditures any considerably by 2015. Yet, there are no effective enforcement measures in place to ensure that these objectives are met, despite the signature of the memoranda of cooperation.

In the CBR’s view, the healthcare sector ranks second on the list of significant risks. The budget proposal contains differing figures for 2012 and fails to provide sufficient explanation of the expected reduction in the number of those insured by the state in 2013. Moreover, the proposal does not contemplate further increase in the debt of healthcare facilities. The Council is of the view that the objectives set for the public healthcare sector are not likely to be achieved without adopting additional measures.

The school system is the third area which is likely to require more funds than budgeted. In view of the dialogue between the government and trade unions, which is currently underway, an increase in salaries of at least 5% will, in all probability, have to be factored into the budget.

The other risks include the budgeted revenue from the sale of state oil reserves without any specific legislative framework in place, and the full use of receipts from the sale of emission quotas for consolidation and deficit reduction at the expense of some state corporations (Cargo, Javys).

The Council views the budget proposal also through the prism of the government’s net worth which, in simplified terms, expresses the difference between the assets and liabilities of the state. However, this also raises consolidation question marks due to possible devaluation of government’s capital assets and an ambitious assumption of revenues from state corporations, from the sale of assets (oil stocks) and the introduction of special levies in the financial sector. Also, the use of the reserve created to cover the [lower-than-expected] exit of savers from the fully-funded pillar to finance current expenditures would be clearly negative from the net worth perspective.

Although the budget proposal contains a reserve to offset potential impairment of economic performance, but it may not be sufficient should all significant risks materialize, including those on the expenditure side. This is why the Council believes that the reining of the next year’s deficit within the target value will require the adoption of additional measures of either operative or systemic nature. In the next two years (2014-2015), the budget scenario is not properly documented (traditional problem) and this is why the CBR feels positive about the ambition to introduce medium-term expenditure ceilings as of 2014. This would broaden the perspective of those administering individual budget chapters from one year to the entire medium-term horizon.

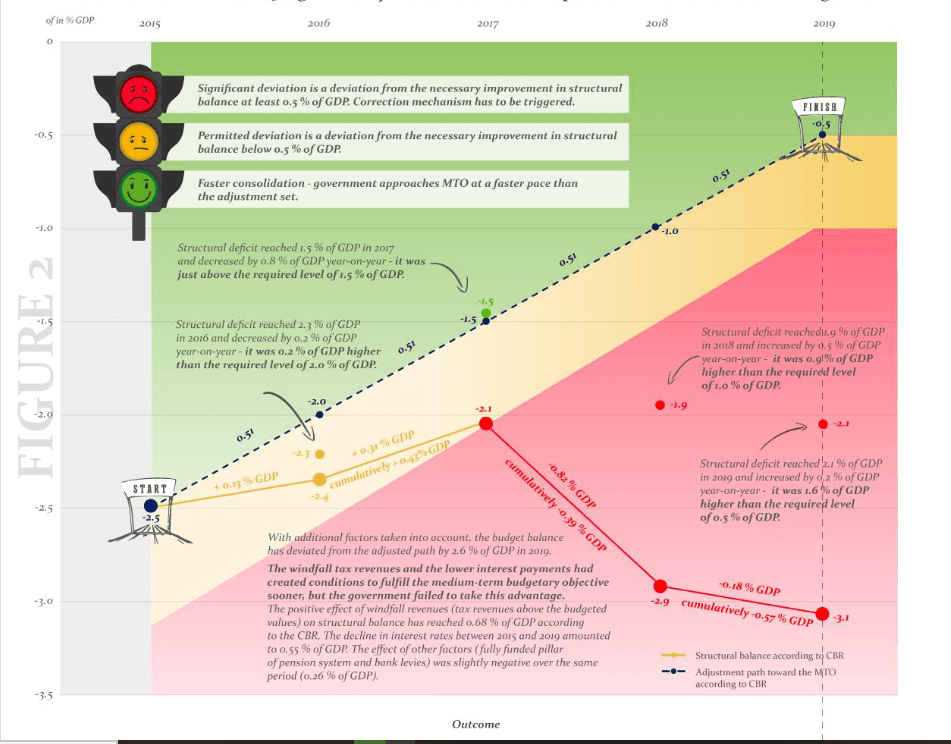

In terms of compliance with fiscal rules in 2013, the budget proposal can be evaluated positively. The proposal is in line with the rules defined in both the domestic and international legislation. However, from a medium-term perspective, the public debt development is alarming. If the scenario outlined in the budget materialized, the Government would have to block 3% of the 2015 budget expenditures and the budget proposal for 2016 should not contain any nominal increase in expenditures (including social security funds).

The CBR highly appreciates those changes in the budget which have made in light of the requirements for the provision of information under the constitutional Fiscal Responsibility Act. Since this is the first year [of its application], there is understandably still room for improvement in terms of the quality of the information provided. In Slovakia, legal requirements are oftentimes met purely formally; however, in this particular case – except for the consolidated balance of revenues and expenditures and the budget execution of state corporations – the information has been provided in a comprehensive and comprehensible manner. Nevertheless, the failure to publish the June Tax Revenue Forecast by the deadline must be viewed negatively.

If we look at the budget from a long-term perspective (together with changes in the pension system), the long-term sustainability of public finances in Slovakia is improving, which is very important in times of uncertainty on financial markets. The Council will prepare its overall long-term sustainability evaluation by 17th December.

Unless the external environment deteriorates significantly, the 2013 budget objective is achievable, however, according to the CBR, the elimination of identified risks will require the adoption of additional operative or systemic measures.