Main conclusions from the evaluation of the GGB proposal for 2022-2024:

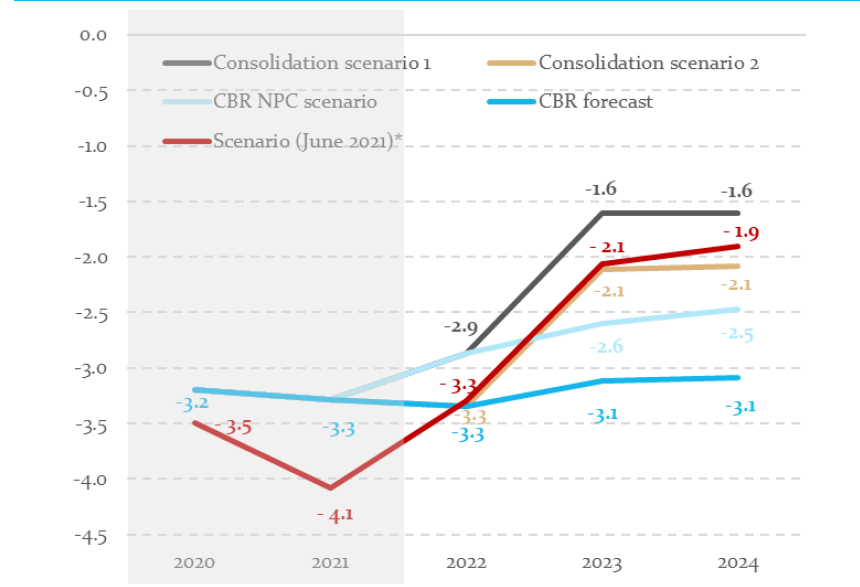

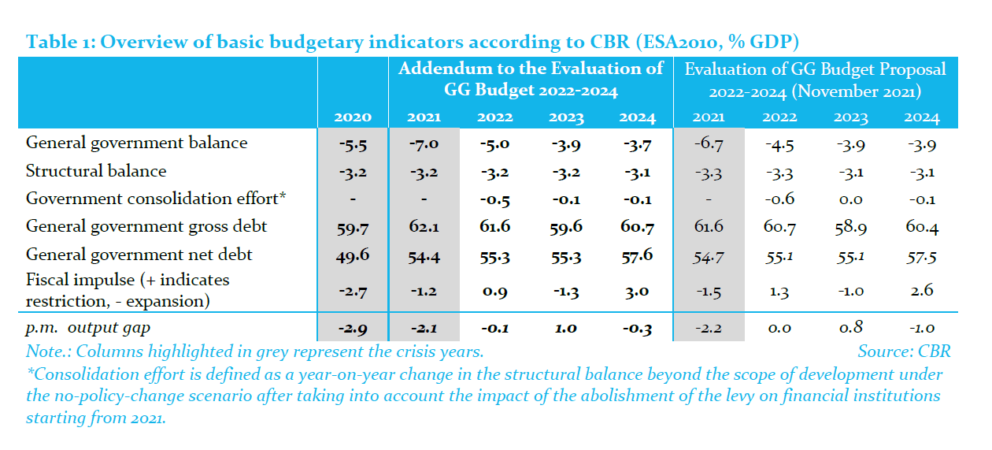

– The Council considers the submitted budget proposal as realistic only for 2022; its deficit estimate at 4.5% of GDP is lower than a comparable estimate of the government. No specific and credible measures that would lend themselves to meeting the objectives set by the government can be seen in 2023 and 2024. According to the Council’s estimate, the specified measures would reduce the deficit only to 3.9% of GDP in 2023 and 2024, instead of 3.4%or 3.3% of GDP.

– Next year, the continuing recovery is expected to bring the economy closer to its potential. This means less need for a fiscal stimulus. The overall effect of public funds on the dampening of economic recovery will be strengthened by the so-called fiscal cliff (caused by a sudden halt in one-off Covid incentives amounting to 2.5% of GDP), which will be only partially offset by an increased influx of European funds (+1.3% of GDP). For this reason, the budgetary policy should remain cautious even in 2022.

– It is positive that a major part of the counter-cyclical policy aimed at protecting the economy in 2021 took place through one-off measures while the structural deficit has remained almost unchanged, according to CBR’s estimate. As the CBR expects a significantly lower deficit (by 1.2% of GDP) in 2021 compared to the deficit envisaged by the Ministry of Finance and because this reduction is not sufficiently carried over to 2022, the CBR’s estimate indicates that the 2022 budget alone (disregarding fiscal reforms) implies a slackening of the consolidation effort by 0.6% of GDP . Naturally, this complicates the fulfilment of objectives for the subsequent years 2023 and 2024. If an improved development of the budget is confirmed in 2021, the government is advised to consider, despite the dampening effect on the economy, an adequate reduction of such slackening and to focus in particular on how to accelerate the spending of European funds.

– The government is not making use of the expected favourable economic development in 2023 – supported by the drawing of European funds and resources under the Recovery and Resilience Plan – for a more significant consolidation by specifying realistic and permanent measures. In 2023, the economy is expected to free itself from the effects of the pandemic in general and there will be optimal conditions for a more substantial consolidation, because the economy will be growing significantly and the negative demand-side effects of consolidation will be offset by the continued acceleration of the influx of European funds. This will therefore provide an opportunity for stabilising the economy (calming down its overheating), including the reduction of domestic inflationary pressures, and also for reducing the debt to a safer level. Based on the presented and sufficiently specified measures, the Council estimates that the government’s consolidation effort will be nearly zero between 2023-2024.

– The deficit development, as estimated by the Council, will ensure the stabilisation of the debt, but not reduce it. With such development, the debt will stabilise above the upper limit of the debt brake, close to the level of 60% of GDP, and its distance from the upper limit will be increasing. According to the constitutional Fiscal Responsibility Act, a new government is not subject to the most stringent debt brake sanctions during the first two years, therefore any potential sanctions will start applying during 2023. What these sanctions will look like also depends on whether and how the constitutional Fiscal Responsibility Act will be amended.

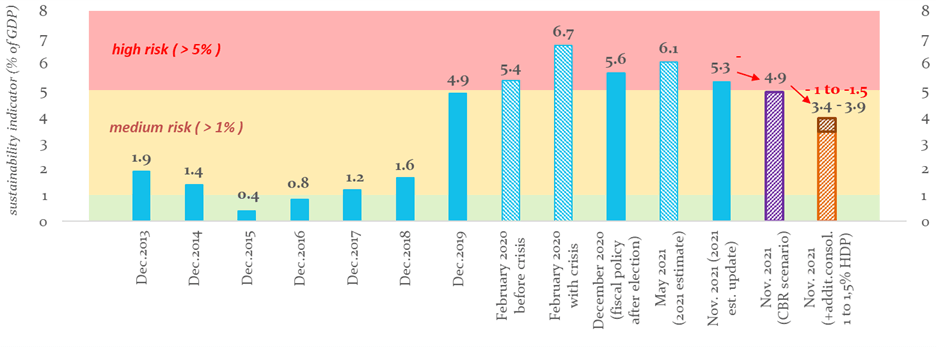

– According to the CBR’s scenario, the budget – along with the adoption of the pension reform as required by the Recovery and Resilience Plan – could reduce the currently high sustainability risk, but only down to somewhere between the medium- and high-risk level. The Council points out that the general government budget alone impairs the long-term sustainability by 0.5% of GDP in 2022 and, over the entire budget horizon, by 0.6% of GDP.

– For achieving a credible and permanent reduction of the deficit below 3% of GDP and, simultaneously, for bringing the long-term sustainability safely into the medium-risk zone, the Council deems it necessary that, in addition to adopting the pension reform under the Recovery and Resilience Plan, consolidation measures quantified roughly at 1-1.5% of GDP should be specified in a credible manner as well. In that case, the government’s fiscal targets for 2023-2024 could be considered realistic.