The structural deficit reached 3.2% of GDP in 2020, deteriorating by 0.6 p.p. of GDP year-on-year when taking into account unexpected revenue shortfalls. As the economy was operating under a crisis regime in 2020, the escape clause of the balanced budget rule allows the government to pursue a robust counter-cyclical policy to stabilise the economy. For this reason, compliance with the rules is not evaluated for this year. In the course of 2021, the economic situation in Slovakia has improved and the Slovak government approved ending the exceptional circumstances as of 30 June 2021. In the approved resolution concerning the proposal for ending the exceptional circumstances, the government also decided that, with regard to non-application of the rules under the Stability and Growth Pact until the end of 2022, the correction mechanism would not be applied also in 2021 and 2022[1].

The CBR’s view is that the Ministry of Finance should have proposed the correction mechanism immediately after the end of exceptional circumstances.

According to the CBR, compliance with the principles of the balanced budget rule requires (based on the existing state of affairs) the adoption – no later than next year – of a correction plan (correction mechanism) which will be binding for budgets throughout the entire duration of the correction. This is determined by the fact that the correction mechanism was triggered in January 2020 for the first time in order to correct an identified significant deviation from the path towards a balanced budget while the situation in public finances has worsened even further during the pandemic. The pandemic only caused a temporary suspension of its application. In order to reactivate it, it is therefore not necessary to identify a significant deviation again[2]. The Ministry confirmed[3] that, as from 2023, it will propose the activation of correction mechanism in the form of expenditure ceilings. The expenditure ceilings are to be introduced via an amendment to the constitutional Fiscal Responsibility Act[4] and should be binding as from 2023.

According to the CBR, the correction mechanism should entail setting expenditure ceilings for the entire duration of correction. It would take into account the adjustment path of the structural balance as determined by the government and the fulfilment of the medium-term budgetary objective based on the updated estimate of the structural deficit for 2021, which the CBR estimates at 3.2% of GDP[5]. Considering that exceptional circumstances have ended during 2021, the deficit reached in 2021 will be the baseline for the evaluation of compliance with the rule and the adjustment path towards a balanced budget.

Because the state of play and the timing of action to follow after the end of exceptional circumstances have been evaluated or interpreted by the CBR and the Ministry differently on a repeated basis, the application of the balanced budget rule needs to be changed in the imminent future. The previous experience has shown that the rule according to which the Ministry evaluates its own compliance with the statutory requirements is not ideal. From the CBR’s perspective it is advisable to have the evaluation made by an independent arbiter, which means merging the balanced budget rule with the public expenditure ceilings that are being prepared and follow the same objective, i.e. attaining the long-term sustainability of public finances.

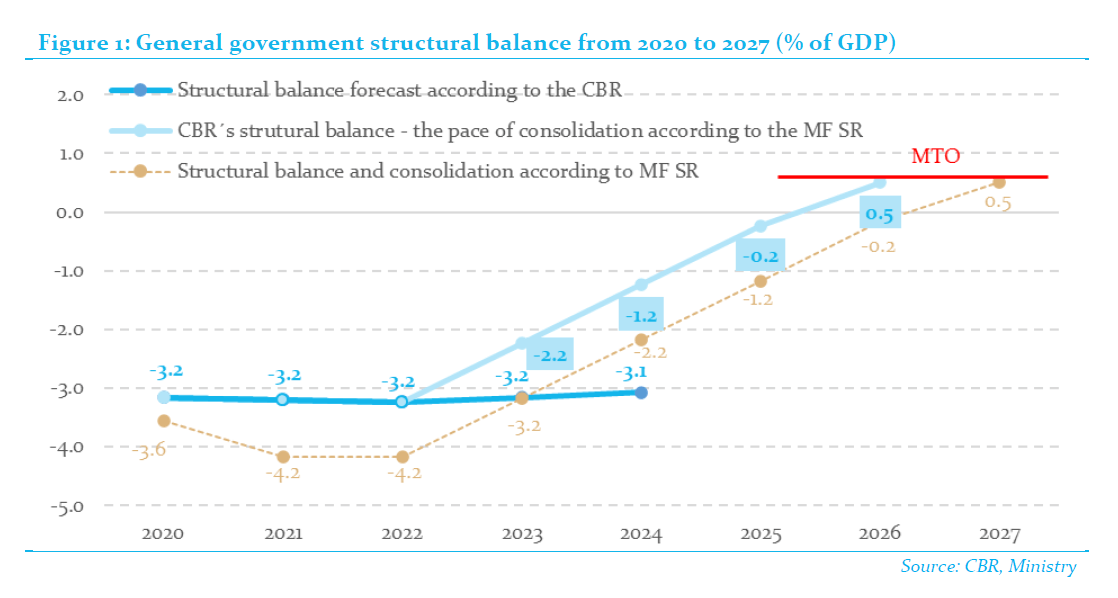

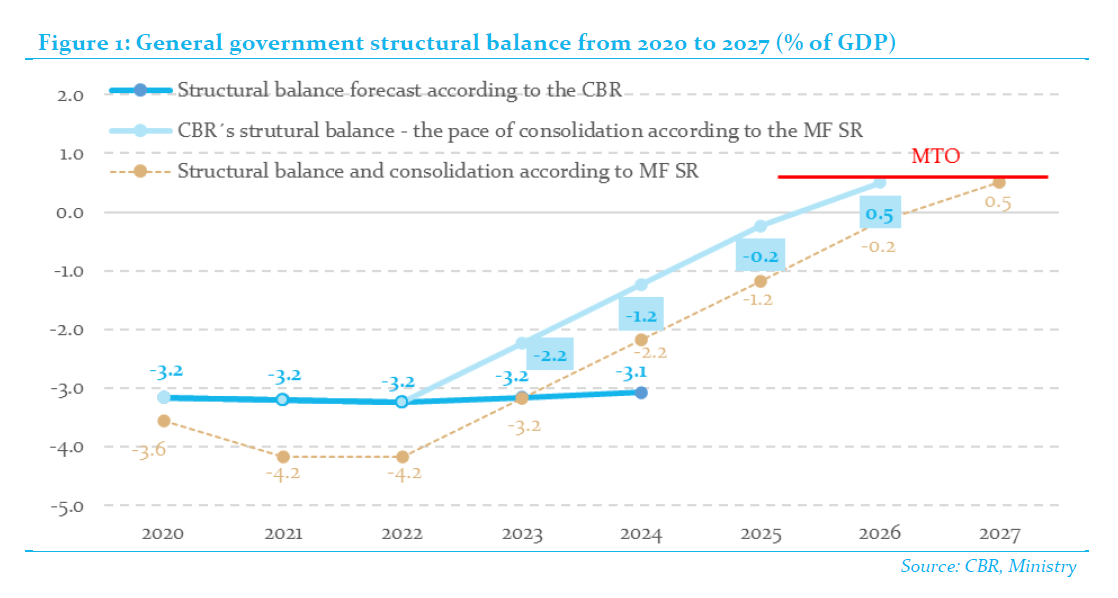

When considering the current developments in public finances in 2021, the medium-term tax revenue forecasts and the government-planned improvement of the structural balance, the CBR estimates that a structural surplus of 0.5% of GDP, as the new medium-term objective of the government[6], should be achieved already in 2026 (Figure 1), i.e. one year earlier compared to the Ministry’s estimate. Therefore, in the case of a significantly lower deficit for 2021, the government should pursue its consolidation plans based on the adjustment path “CBR’s structural balance – consolidation according to the Ministry of Finance” presented in the above chart, because this will be the basis for its ex-post evaluation.

[1] In this connection, the CBR has identified several questionable issues casting doubt on whether the government’s actions are in line with the balanced budget rule and the correction mechanism principles, such as its failure to justify non-application of the correction mechanism after the end of exceptional circumstances, lacking statutory power of the Ministry of Finance to propose non-application of the correction mechanism to the government, the failure to request CBR to provide an opinion on this proposal (more details can be found in CBR, Evaluation of the Balanced Budget Rule for 2020 (available in Slovak only), July 2021, chapter 3). In August 2021, the Ministry issued its opinion regarding the CBR’s evaluation where it stated its reasons for non-application of the correction mechanism immediately after the end of exceptional circumstances (https://www.mfsr.sk/files/archiv/73/FK_StanoviskokhodnoteniuRRZ_FINAL.pdf, available in Slovak only). However, no reaction was provided to other objections raised by the CBR.

[2] This conclusion was also confirmed by a legal opinion commissioned by the CBR with respect to the application of the correction mechanism, as published in Annex No. 6 to the analytical document (available in Slovak only).

[3] Considering the possible different interpretation of conclusions presented in the Ministry’s evaluation, the CBR requested the Ministry to provide a statement regarding the activation of the correction mechanism after 2022. The Ministry’s statement forms part of the Opinion of the Ministry of Finance of the Slovak Republic concerning the evaluation of the Council for Budget Responsibility as regards compliance with the Balanced Budget Rule for 2020, which is published along with the present document (available in Slovak only).

[4] If the expenditure ceilings are introduced by means of an amendment to the constitutional act, their linkage with the correction mechanism under the balanced budget rule would probably require an amendment to the legislative wording of the rule itself (with the key contrast being that expenditure ceilings under the constitutional Act would be a permanent rule approved by the Parliament, whereas the correction mechanism is of temporary nature according to the current wording of the rule and the government may refuse it while at the same time justifying the reasons for its non-application to the parliament).

[5] The CBR’s estimate also includes the effects of new measures adopted in the course of December 2021 (signature of the collective agreement in terms of remuneration, legislative changes in the parliament approved at its session in December).

[6] In April 2021, the government set its medium-term objective in the Stability Programme for 2021-2024. Even though the level of this objective is stricter than the minimum value required by the rule, its attainment would not suffice in terms of the long-term sustainability of public finances, unless significant structural reforms in areas sensitive to population ageing are implemented simultaneously (namely the pension system, healthcare and long-term care services). Without reforms, a structural surplus of around 2 % of GDP would be necessary in order to essentially reduce the risks for long-term sustainability to the low-risk zone (CBR, Report on the Long-term Sustainability of Public Finances as at 18 May 2021, June 2021).