Main conclusions from the evaluation of the GGB proposal for 2021-2023:

Evaluation of the General Government Budget Proposal for 2021-2023 (November 2020)

- 16. 11. 2020

Main conclusions from the evaluation of the GGB proposal for 2021-2023:

• The Council considers the submitted budget proposal to be realistic, the deficit estimates prepared by the CBR for the years 2021-2022 are slightly lower than those of the government.

• Given the need to support the economy weakened by the pandemic, the Council does not consider the absence of consolidation measures for 2021 to be a key problem. Majority of additional measures, in particular the one-off measures to address the pandemic, have a minimum negative impact in terms of long-term sustainability of public finances.

• The consolidation effort in 2022 and 2023 should be much more ambitious. The Council recommends that a detailed consolidation path, by at least 1.5 % of GDP on a cumulative basis, should be prepared so that the structural deficit would be reduced to 3.6 % of GDP by 2023. The need for consolidation is intensified by a high structural deficit and the ensuing high debt, as well as by the absence of a more specific and comprehensive pension reform, which could considerably strengthen the currently destabilised pension system. During the inevitable consolidation, the resources from the EU recovery fund should serve as the source of a fiscal stimulus.

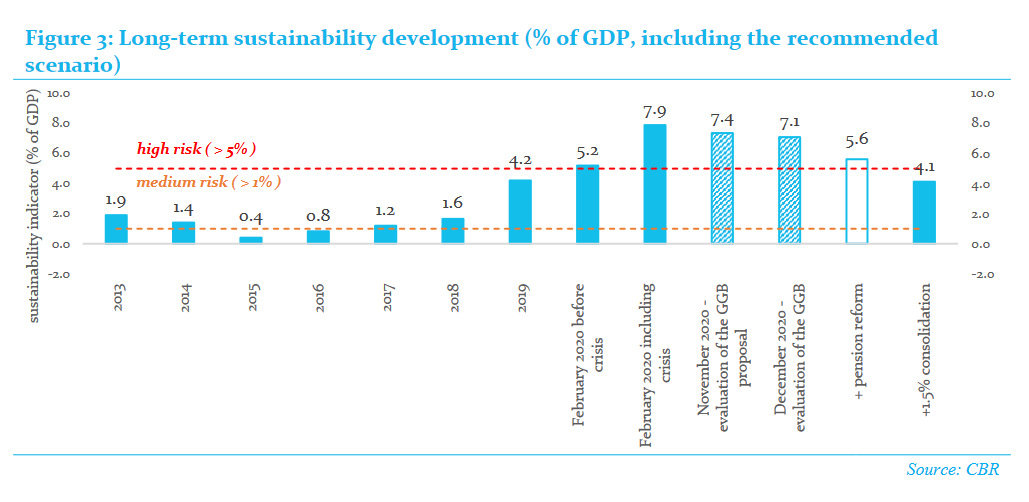

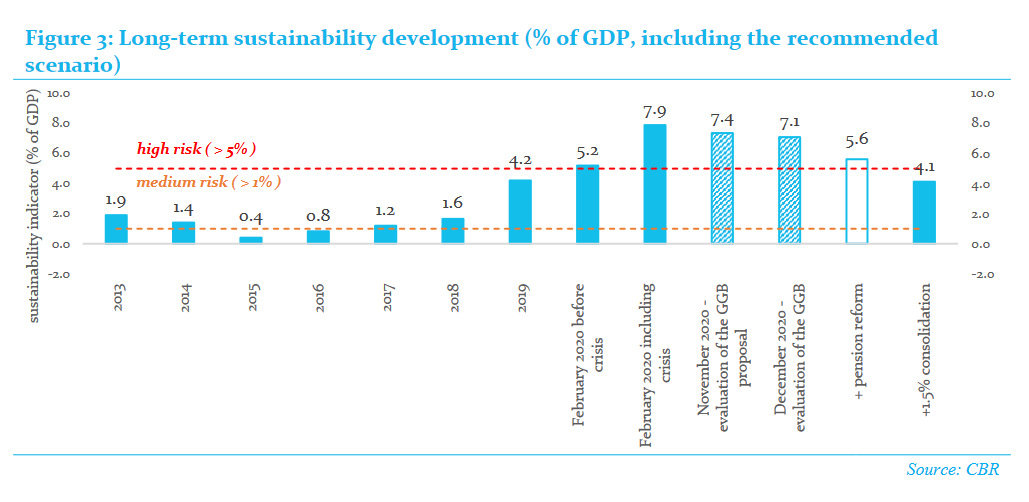

• Slovakia’s public finances were in a high-risk zone in terms of long-term sustainability already before the crisis. The Council regards as positive that the introduced measures regarding the 13th pension payments and the minimum pension have been amended, thus reducing their negative impact on the sustainability of public finances. The Council also welcomes a reform in the financing of public investments. However, long-term sustainability will not improve without adopting additional measures and will instead remain within the high-risk zone even at the end of the budget horizon.

• If this trend continues, the debt will remain above the upper limit of the debt brake and the distance from that limit will be increasing. According to the Fiscal Responsibility Act, a new government is not subject to the most stringent sanctions of the debt brake during the first two years in office. In October, the government adopted a new proposal for the Fiscal Responsibility Act which adjusts certain rules of the debt brake. The type of debt brake rules – including expenditure ceilings – which are to be applied in the upcoming period will be known after the government’s proposal is either approved or turned down by the parliament.

• In the case of a better-than-expected economic development, for instance, as a result of spending financial resources from the EU recovery fund, all positive aspects (including the unspent part of the reserve to address the impacts of the pandemic) need to be strictly reflected in the improvement of fiscal performance. The planned introduction of expenditure ceilings already during this election term should significantly contribute to achieving this objective.