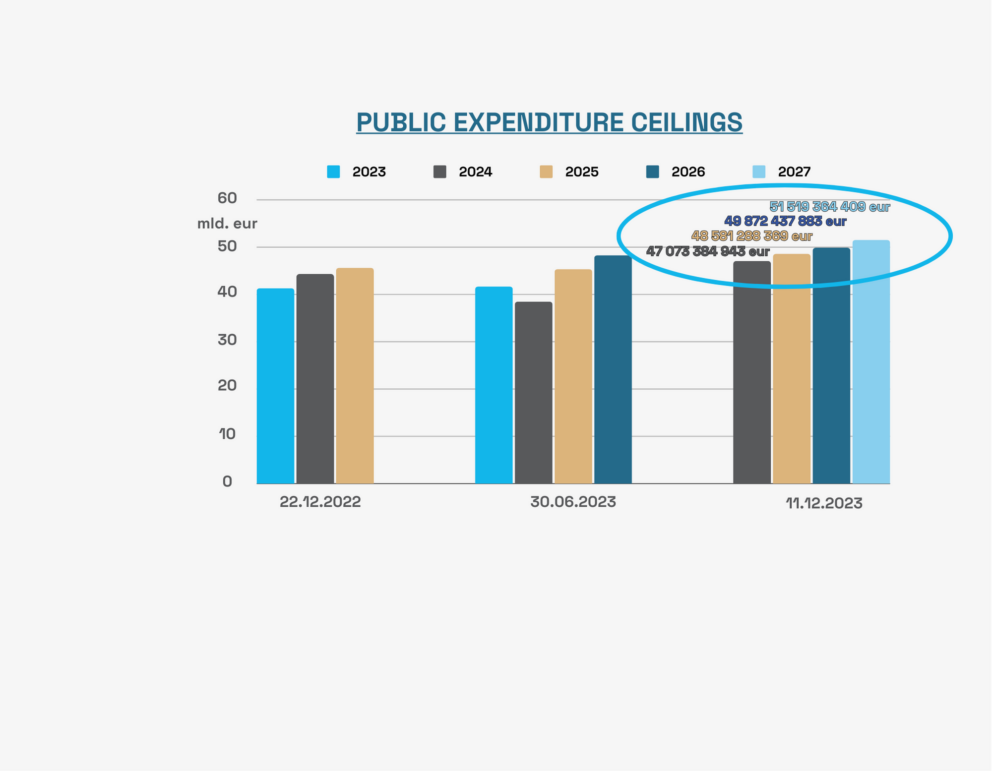

Public expenditure ceilings are a key operative budgetary tool designed to ensure long-term sustainability of public finances, which is defined in §30aa of Act No. Coll. on the general government budgetary rules. It sets the maximum expenditure which the government should not exceed. Public expenditure ceilings are calculated by the CBR always following an election to the parliament, for each year of the government’s term in office, starting by the year following the year in which the parliament approved the government’s manifesto and the vote of confidence in the government.

The ceilings apply to selected general government expenditures which are under direct government control and are relevant in terms of achieving a planned general government balance, debt development and long-term sustainability of public finances. The total sum of the general government expenditure subject to the ceilings is approximately 75% of all general government expenditure. On the contrary, expenditures such as local government expenditure, funding from the EU budget, co-financing of joint Slovakia-EU programs, transfers to the European Union, expenditures on general government debt service and one-off expenditures do not fall under the ceilings. The common characteristic of these expenditures is that their development can be influenced by factors which are out of the government’s control. A detailed description of expenditures subject to the public expenditure ceilings, including their identification, is provided in the Methodology for calculation of public expenditure ceilings.