Summary

(Find the complete Addendum for download below)

The Council for Budget Responsibility (the Council, CBR) has updated its evaluation of the general government budget for 2023-2025. The addendum evaluates the differences between the government’s budget proposal and the version adopted by the National Council of the Slovak Republic (the parliament). The evaluation also takes into account additional documents provided by the Ministry of Finance of Slovak Republic (the Ministry and/or the Ministry of Finance).

Compared to the government’s proposal, the budget adopted by the parliament underwent only formal changes in terms of structure, while the expected levels of the general government budget balance in individual years have remained unchanged. The changes were related to the structure of expenditures under the chapters of the 2023 state budget, which reflected, to the same degree, an increase in the level of total general government revenue and expenditure. For 2023, the approved budget envisages a general government deficit of 6.4% of GDP, and in 2024 the deficit is expected to stand at 4.3% of GDP and in 2025 at 4.1% of GDP.

Taking into account the changes compared to the government’s proposal, even the budget approved by the parliament is assessed by the Council as realistic in 2023. However, after considering the most recent developments, the positive risks for 2023 have been reduced from 0.8% to 0.5% (i.e. EUR 562 million), and the Council has updated its deficit estimate to 6.0% of GDP, mainly due to the impact of higher projected costs of schemes addressing higher energy prices.

The fact remains that, for 2024 and 2025, there are no concrete and credible measures that would contribute to meeting the targets set by the government. Based on the Council’s estimate, the specified measures would reduce the deficit only down to 4.2% of GDP in 2024 and to 4.5% of GDP v in 2025. In particular, the estimate for 2025 is 0.6% higher (EUR 842 million) than the budgetary balance envisaged by the Ministry of Finance; therefore, the budget prepared in those years cannot be considered realistic. Furthermore, when considering the targets declared by the government, specific measures in the amount of 0.9% of GDP in 2024 and 1.9% of GDP in 2025 are lacking.

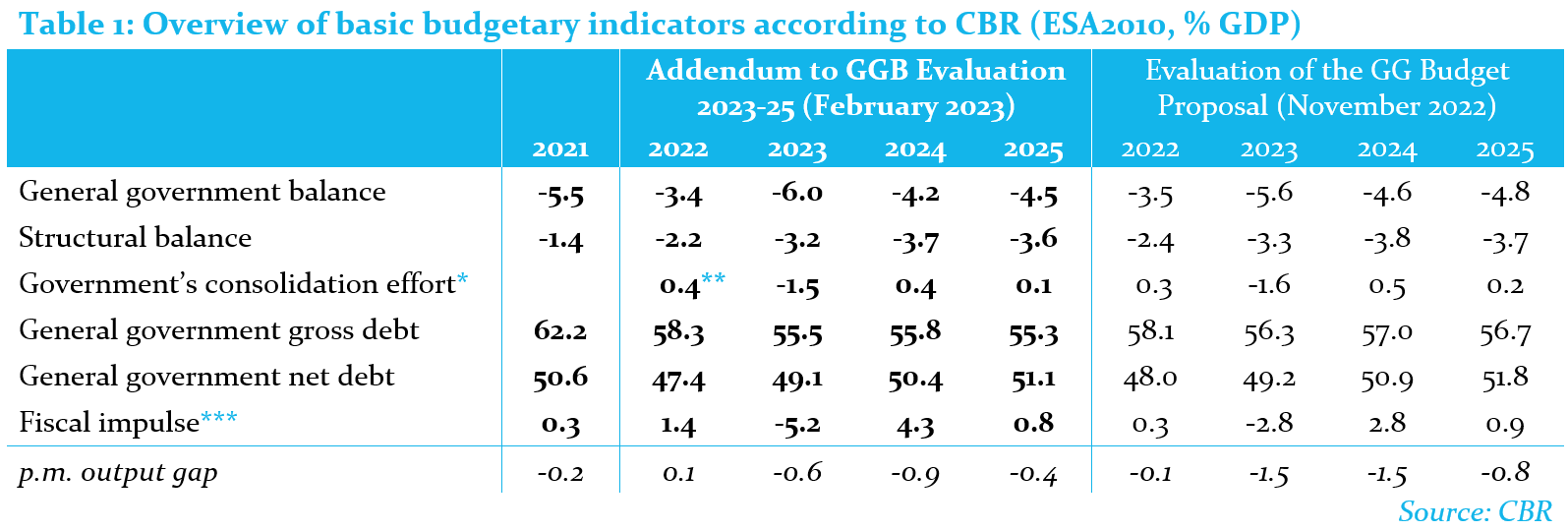

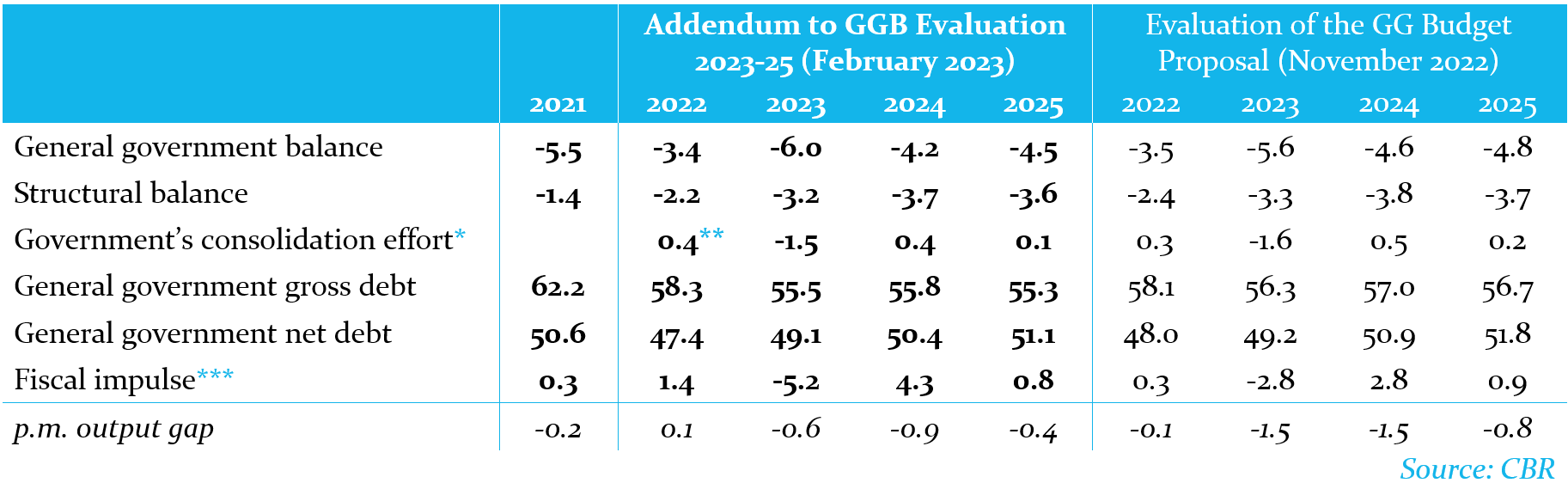

Table 1: Overview of basic budgetary indicators according to CBR (ESA2010, % GDP)

*Consolidation effort is defined as a year-on-year change in the structural balance beyond the scope of development under the no-policy-change scenario.

** An estimate derived by comparing the development in structural balance under the NPC scenario based on the situation in 2021 according to the CBR’s most recent macroeconomic forecast (structural deficit of 2.6% of GDP in 2022) with the CBR’s current estimate (structural deficit of 2.2% of GDP in 2022).

*** (+ means restriction, – expansion)

The CBR slightly decreased the 2022 deficit estimate to 3.4% of GDP based on updated assumptions concerning the development of public finances (slower spending of state budget expenditure at year-end[1]). This positive impact on the budget was partly mitigated by the effect of additionally adopted measures (contribution to the SPP gas company’s equity fund and the stabilisation contribution (retention bonus) for health care professionals). For 2022, we are therefore estimating the consolidation effort at 0.4% of GDP. The higher deficit expected in 2023 as compared to the forecast in the evaluation of the budget proposal[2] is mainly due to the higher projected spending of one-off expenditure to compensate for high energy prices, as well as the negative impact of newly adopted measures (an additional wage increase for health care professionals and changes in taxes and social contributions).

The reduction in the estimated level of the balance is also reflected in a further decline of the general government debt level, with the gross debt expected to reach 55.3% of GDP[3] at the end of 2025. Considering the gradual decrease in the thresholds of sanction brackets, this would mean that the 2025 debt will remain more than 3 p.p. above the upper limit of the debt brake over the entire forecast horizon. The budget does not include measures conducive to meeting the debt brake sanctions after 5 May 2023, which is the date of expiry of the escape clause allowing exemption from sanctions triggered as a consequence of surpassing the third, fourth and fifth sanction bracket of the constitutional law. After this deadline, the government would be required to block 3% of selected state budget expenditures. At the same time, it should draw up a proposal for a balanced general government budget for 2024, containing no increase in public expenditures.

The net debt would stand at 47.4% of GDP at the end of 2022. Due to the absence of consolidation measures at the end of the medium-term horizon (the end of 2025), the CBR expects the net debt to gradually rise to 51.1% of GDP.

An updated evaluation of the general government budget for 2023-2025 has not resulted in a change in the long-term sustainability risk, which is still estimated to remain within the high-risk zone. In order to achieve the long-term sustainability, revenues would need to increase and/or expenditure decrease by more than EUR 6.4 billion (5.2% of GDP). Compared to the initial evaluation of the budget proposal, the additional negative impact of higher wages for health care professionals and of new measures adopted by the parliament was offset by lower investment expenditures. Adjusted[4] for these factors, the long-term sustainability of public finances for 2022 will improve by 0.1% of GDP year-on-year. The major contribution to this improvement comes from the pension system reform (1% of GDP) and expected savings of local governments (0.3% of GDP). By contrast, the remaining government measures worsen the sustainability by 1.2% of GDP. The Council therefore points out that, without the pension system reform, the approved general government budget has a negative impact on the long-term sustainability because the pension reform savings will only be felt after the budget period.

In the approved budget, there were no significant changes in the assumed consolidation effort; according to the Council’s estimate, the cumulative contribution of permanent measures to the widening of the deficit between 2022 and 2025 will be 0.6% of GDP. The 2023 budget itself implies loosening of the consolidation effort by 1.5% of GDP in particular due to the adopted legislation[5]. The Council expects that this expansion will be partly offset by the developments in the upcoming years (improvement of 0.4% and 0.1% of GDP, respectively), but this improvement is mostly associated with the assumption that local authorities will be forced to offset the shortage in revenues caused by legislative changes and the increased spending on compensations and intermediate consumption not covered by revenues by permanent cuts in operating expenditure (contribution of 0.3 p.p.). If this assumption did not materialise, the government measures would contribute cumulatively 0.9% of GDP to the deterioration of the balance between 2022 and 2025.

Expenditure ceilings for the years 2023 to 2025 have been approved but are not implemented in the budget due to the activated general escape clause. After the adoption of the State Budget Act, the public expenditure ceilings for the years 2023 to 2025 were calculated and submitted[6] by the CBR to the parliament on 22 December 2022 (immediately after reaching an agreement on methodology with the Ministry of Finance). The parliament approved the ceilings on 1 February 2023. While in 2023 the budgeted expenditures are approximately at the level of the calculated ceiling, in 2024 and 2025 the ceilings are exceeded and, in order to meet the ceilings, it will be necessary to adopt additional measures amounting to EUR 360 million in 2024 and EUR 926 million in 2025, which would imply a deficit at 4.0% of GDP in 2024 and 3.4% of GDP in 2025. At present, due to the newly introduced general escape clause, the government is not required to align the budget with the ceilings after their approval in the parliament. The budget is to be aligned with the applicable ceilings only after the escape clause is deactivated, which the European Commission expects to happen from 2024 onwards.

As also required by the constitutional Fiscal Responsibility Act, the presentation of the medium-term consolidation measures is necessary, because the debt has been above the highest sanction bracket of the debt brake since 2020. Following the publication of the 2021 debt in April 2022, the government approved the document as late as in January 2023, while it does not contain any relevant measures aimed at bringing the debt-to-GDP ratio down to safe levels.

In terms of transparency, the fact that the total budgeted level of tax revenue is not in line with the current state of legislation, as adopted at the time of approval of the budget, is regarded negatively by the Council. The forecast of revenues from taxes and social contributions, as well as of selected non-tax revenues and expenditures, was approved by the Tax Revenue Forecasting Committee (TRFC) already in September 2022. Since then, a number of legislative changes with significant impacts on the general government balance have been adopted, but their impacts have not been assessed by the TRFC. So, even though the budget is consistent with the TRFC’s conclusions, neither of them reflects the applicable legislation. At the same time, a number of tax-related measures have been adopted using the fast-track procedure, with many of them attached as amendments to unrelated laws. Such conduct is not in line with the Act on the Rules of Procedure of the National Council of the Slovak Republic.

The Council has repeatedly noted that the existing legislative framework governing the budget approval procedure in the parliament does not fit the scope and content of the documents that are being approved. The approval of a cash-based (and only) state budget by the parliament for the next year is based on a historical tradition, but is no longer sufficient for capturing the key monitored parameters of public finances and all changes in public finances in accordance with the European standards defined by the ESA2010 methodology, including the newly adopted expenditure ceilings.

(Find the complete Addendum for download below)

[1] Lower-than-expected spending was seen in personnel expenditure and expenditure on goods and services, as well as in expenditure incurred with regard to the financing of temporary measures related to the war in Ukraine and the compensation for higher energy prices.

[2] In the evaluation of the budget proposal, the CBR estimated the general government deficit at 3.5% of GDP in 2022, 5.6% of GDP in 2023 and, subsequently, at 4.6% of GDP in 2024 and 4.8% of GDP in 2025.

[3] In its evaluation of the budget proposal in November 2022, the CBR estimated the general government gross debt level at 56,7% of GDP at the end of 2025.

[4] The deterioration of the long-term sustainability in 2022 is partially driven by external factors, namely Russia’s aggression against Ukraine and the energy crisis (deterioration of 0.7% of GDP), and by the introduction of the automatic entry to the second pension system pillar (deterioration of 0.7% of GDP) which, however, is regarded positively by the Council.

[5] The CBR quantifies the “consolidation effort” by comparing the structural balance development against the NPC scenario. This gives a more accurate picture of the “size of measures” de facto adopted by the government through the budget. The Ministry of Finance, as well as the EC, calculate “consolidation” as a year-on-year change in the structural balance. Even though this approach is an internationally accepted standard, it is simplified in that it assumes no year-on-year changes in the structural balance, as long as the government adopts no additional measures.

[6] CBR, Public expenditure ceiling for 2023-2025, 22 December 2022, parliamentary paper No. 1342.