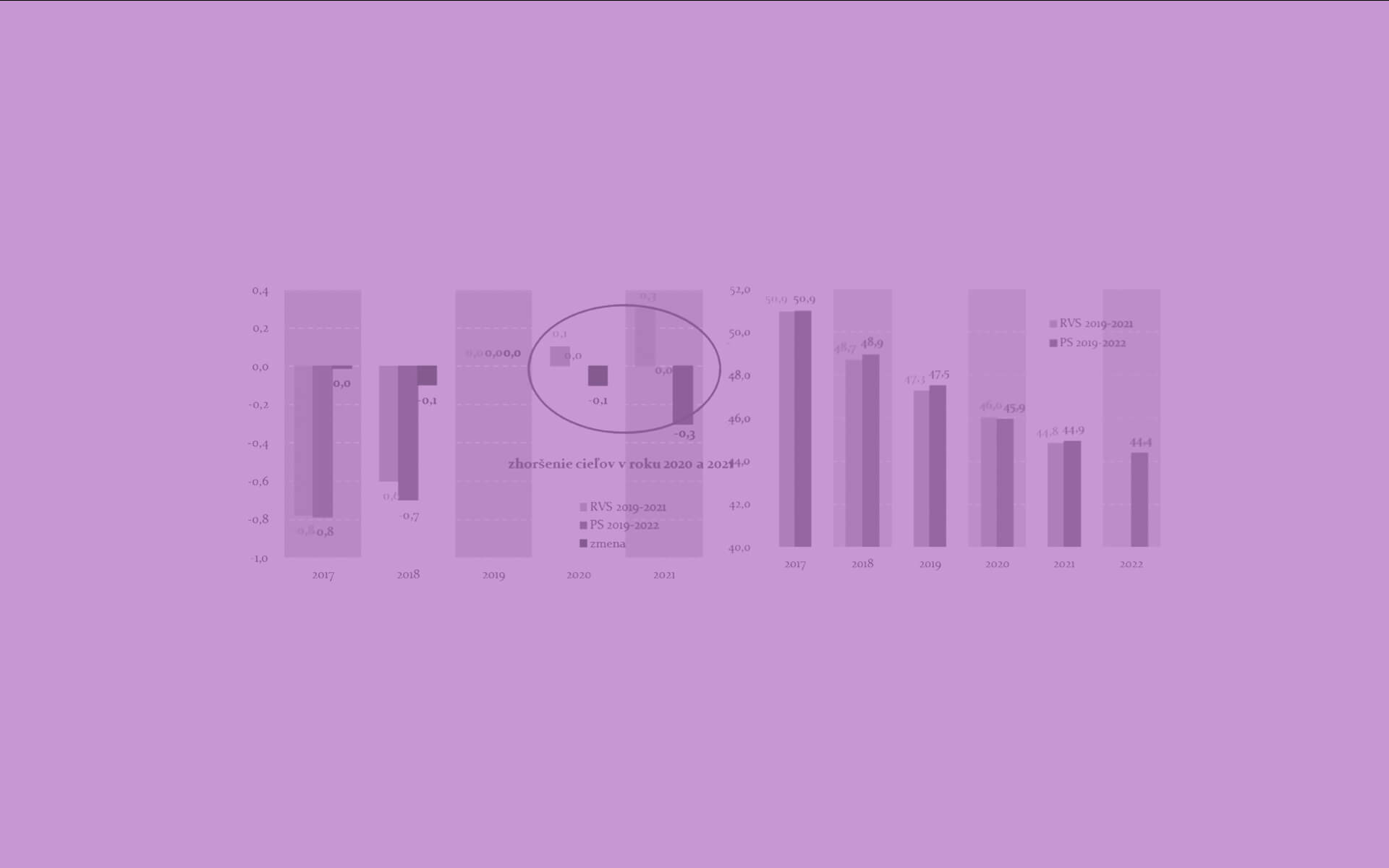

In its Stability Program of the Slovak Republic for 2019 – 2022, the government approved its medium-term objectives assuming general government deficit reduction from 0.7 % GDP in 2018 to balanced budget during 2019 – 2022.

Evaluation of Medium-term Budgetary Objectives for 2019-2022

- 13. 6. 2019