Based on data published by the Statistical Office of the Slovak Republic on 17 April 2024 – the spring notification on deficit and debt.

Summary

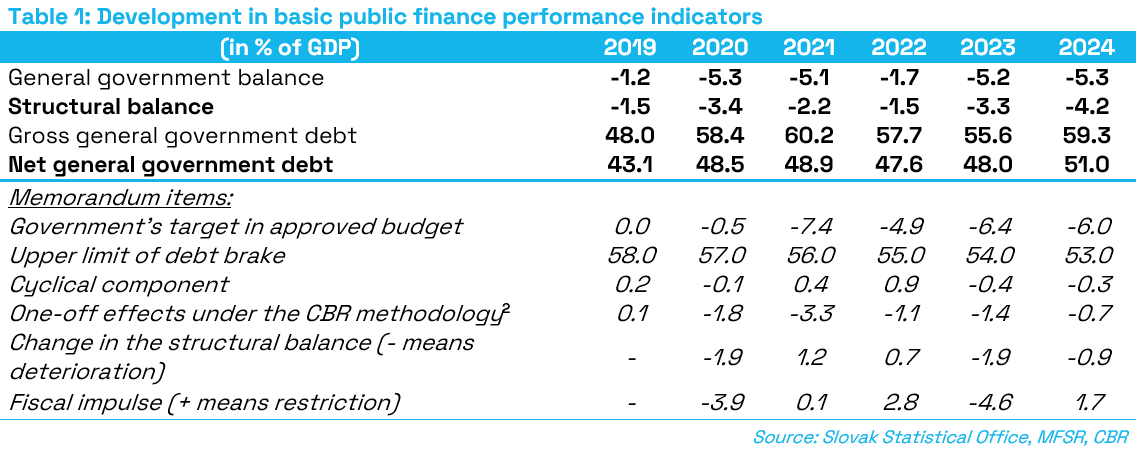

Slovakia’s general government [1] deficit reached the level of 5.3% of GDP in 2024, which represents a moderate increase of 0.1% of GDP above the high deficit level of the previous year. Compared to the deficit target of 6.0% of GDP, the final general government deficit represents a positive albeit rather temporary deviation of 0.7% of GDP which was primarily caused by delayed delivery of military technology and equipment. Gross debt stood at 59.3% of GDP, up 3.6 percentage points year-on-year, while its final value was 1.0% of GDP higher than assumed in the budget, partly also due to an increase in the cash reserve. This means that the public debt is as much as 6.3% of GDP above the upper limit of the debt brake.

The largest positive deviation[3] of the general government’s fiscal performance in 2024 from the approved budget was caused by lower defence expenditure (0.7% of GDP). According to the budget, the defence expenditure was supposed to amount to 2.7bn euros (2% of GDP), but the actual spending, including accruals, totalled 1.7bn euros only. Savings on investments were associated with postponed deliveries of military equipment[4]. At the same time, a portion of the expenditure on goods and services consisted of advance payments which had not been envisaged in the budget at that level. The above-mentioned savings with a positive impact on the general government balance can be considered temporary because lower deliveries mean that they will be rolled over to the following years and, at the same time, the operating advance payments should be reflected in the deficit accordingly.

By contrast, the largest negative deviation from the approved budget was primarily the result of expenditure spent on energy subsidies (0.2% of GDP), which the budget had assumed would be financed from EU funds, but under the ESA 2010 methodology, this expenditure had correctly been recorded in 2023. As in the case of the defence spending, this is only a temporary factor because it involves measures that have been taken in order to address exceptional circumstances.

Permanent changes resulting in the balance developing differently from the budget include the following:

- Positive contributions came from a better-than-expected fiscal performance by both other general government entities and the local governments, which improved the budgetary outcome by 411mn euros (0.3% of GDP) and 312mn euros (0.3% of GDP), respectively. The improvement was largely caused by lower expenditure spending. Even though a portion of these savings is temporary, especially the slower pace of investment in the Valaliky industrial park, the largest part of fiscal improvement can be considered permanent in terms of the general government balance.

- On the other hand, the negative development in the general government deficit compared to the budget was mainly driven by lower tax and social contribution revenues, with a negative impact of 246mn euros (0.2% of GDP), and higher healthcare expenditures, with a negative impact of 161mn euros (0.1% of GDP).

From the point of view of a medium-term burden on public finances, it is better to focus on the structural deficit indicator (i.e., a deficit that will automatically last even into the future, if no additional measures[5] are adopted). The structural deficit amounted to 4.2% of GDP in 2024, an increase of 0.9 p.p. against 2023. This year-on-year deterioration in the structural deficit has been largely caused by the effects of economic development with no measures, a so-called no-policy-change (NPC) scenario. The increase in the deficit is the result of a slower increase in tax revenues compared to the growth of nominal GDP, as well as a delayed increase in public spending in response to the increase in inflation observed in the previous years. At the same time, the deficit is also increasing due to the measures implemented by previous government cabinets, which contribute to a gradual increase in public expenditure (notably an amendment to the School Act and additional funding for tertiary schools in relation with the Recovery Plan). Finally, due to advance payments for, as well as postponed deliveries of military equipment, accrued defence spending in 2024 was significantly lower than the cash expenditures counting towards the NATO commitment. Therefore, the expected deliveries of military equipment will increase the structural deficit level in the medium term. For these reasons, the 2024 structural balance may not give a full picture of public finances in the medium term.

New measures implemented by the government when approving the 2024 budget as well as throughout this year have contributed to a reduction of this year’s structural deficit. These involved, for the most part, changes increasing the tax and non-tax revenues; however, with a temporary impact on the general government results in most cases. On the other hand, the government has also adopted measures having a negative impact on the general government balance, notably the approval of the full 13th pension payments, the establishment of a new ministry, as well as an increase in health sector expenditure. With temporarily reduced defence spending in combination with an increase in revenue from temporary measures, the budget had a minimum impact on the condition of public finances in the long term. The fiscal performance results in 2024 therefore did not indicate any improvement in long-term sustainability.

In 2024, gross debt stood at 59.3% of GDP. After a temporary decline between 2022 and 2023 attributable to high inflation and reductions in cash reserves, this represents a year-on-year increase by 3.6 p.p. from 55.7% of GDP in 2023. Therefore, the gross debt in 2024 increased more prominently above the upper limit of the debt brake.

The government’s management of the primary deficit (contributing 3.9 p.p. to the increase) and the impact of interest costs paid on public debt servicing (a contribution of 1.4 p.p.) were the largest contributors to the year-on-year increase in debt in 2024. The higher cash reserve of the government compared to the previous year has also played its role in the year-on-year debt increase (by 1 p.p.).

On the other side, inflation through the denominator effect (−2 p.p.) and real economic growth (−1.1 p.p.) helped reduce the year-on-year increase in debt. However, as the inflation rate in 2024 drew much nearer to the 2% target after having seen double-digit values in 2022 and 2023, its impact – even when combined with real economic growth – did not suffice to outweigh the factors behind the rising debt.

The sharp rise in the absorption of EU funds in 2023, coupled with significantly low absorption under the new programming period as well as lower-than-expected spending of funds under the Recovery and Resilience Plan, have resulted in a relatively significant restrictive fiscal impulse for the economy at 1.7% of GDP. With the economy cooling off slightly in 2024, the negative output gap reached 0.4% of the potential GDP. The strong fiscal restriction was mainly attributable to a year-on-year decline in the spending of EU funds, by 1.2% of GDP, as well as to a reduced impact of measures to compensate for higher energy prices, by 1% of GDP, whereas the impulse generated by the rest of the budget was expansionary, standing at 0.5% of GDP.

Total expenditures incurred in financing the measures adopted by the government in response to exceptional circumstances, i.e. compensations for the high growth in energy prices, as well as for addressing the situation in connection with the Russian invasion of Ukraine, amounted to 1.2bn euros (0.9% of GDP). With revenue-increasing measures considered, the impact on the general government balance in 2024 amounted to 1.0bn euros (0.7% of GDP) and consisted entirely of one-off measures with no effect on the structural deficit. At the same time, the budget expected the financing of temporary measures from the reserve for compensation measures in connection with growing energy prices at 0.8bn euros, having a total impact on the deficit of 0.5bn euros when taking revenues into account. However, the spending under temporary measures was significantly higher, in particular due to an insufficient reserve for energy compensations which was caused, for the most part, by incorrect budgeting of EU refunds under revenues for 2024. The revenues from refunds were recorded in 2023 based on the ESA 2010 methodology, while the CBR warned about this budgetary risk already at the time of budget preparation. Taking these adjustments into account, the deficit was higher compared to the budget by 0.3bn euros (0.2% of GDP). Without the impact of one-off measures and non-spending of defence expenditure, the deficit would have been lower by 0.4bn euros (0.3% of GDP) – see Chart 3.

- The costs of measures to compensate for the high growth in prices totalled 1,126mn euros (0.9% of GDP). The government operated multiple aid schemes aimed at stabilising gas and heat prices for households and various types of companies or institutions. The expenditure was partly offset by windfall revenues standing at 173mn euros (0.1% of GDP) from the solidarity contribution from activities in selected economic sectors and from the levy on surplus revenues of power plants. As a result, the measures to compensate for a steep rise in energy prices increased the general government deficit by 851mn euros (0.7 % of GDP).

- The costs of financing other measures taken in connection with the Russian invasion of Ukraine amounted to 98mn euros (0.1% of GDP). The expenditures were spent on humanitarian aid, contributions for the accommodation of refugees and other additional costs.

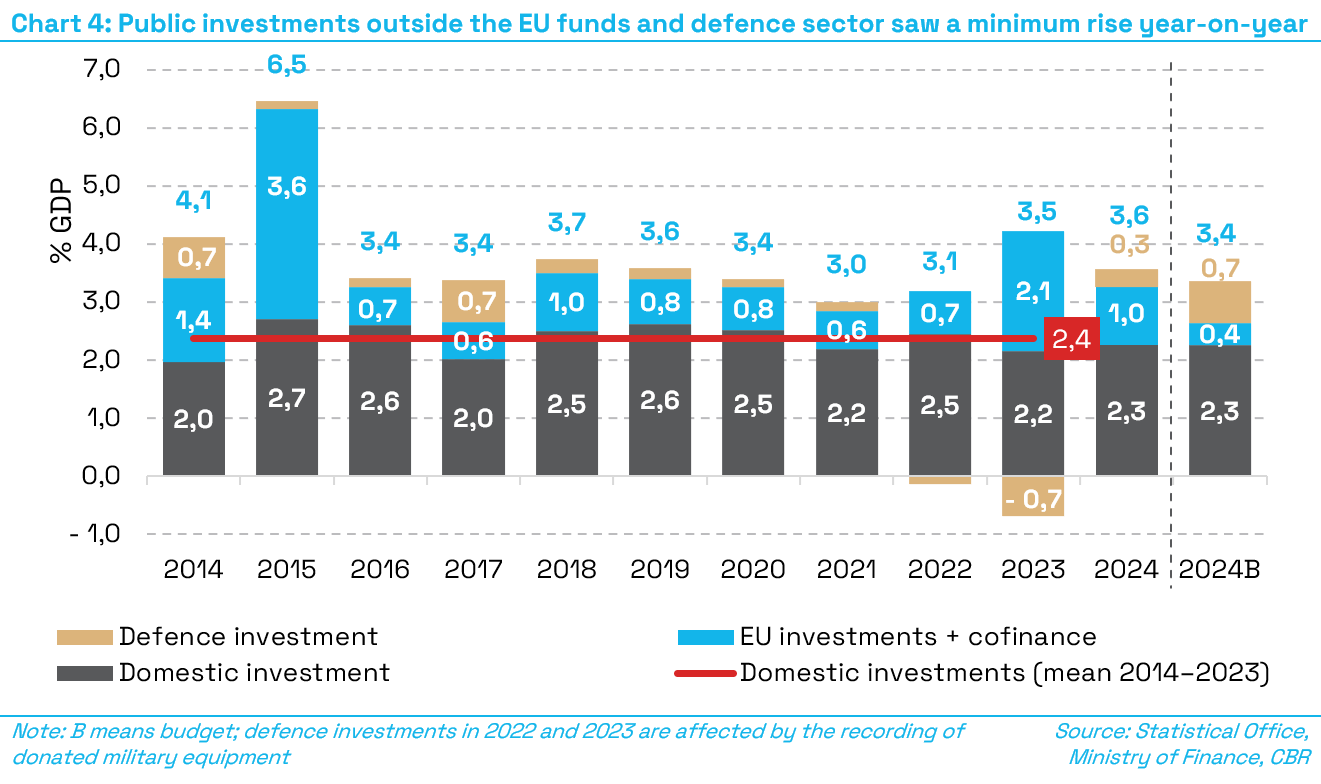

Long-term economic growth is important from the perspective of long-term sustainability. It can be supported by the formation of new capital through effective public investments. Because the flow of European funds depends on a longer-term spending plan, as well as on the relevant programming period schedule, it will be interesting to observe the development of domestic public investments. At the same time, it is advisable to deduct the investments related to the military equipment, because the size of these expenditures recorded in the budget balance under ESA 2010 is to a large degree affected by delivery dates. In 2024, the spending under public investments outside the defence sector and EU funds increased slightly year-on-year, with the budgeted capital expenditure reaching 2.3% of GDP. The final size of domestic investments was slightly below the level of the historical average since the previous crisis.