Main conclusions and recommendations

The Council for Budget Responsibility (the Council, CBR) evaluates the development of public finances in order to achieve their long-term sustainability. Slovakia’s public finances are currently reaching a high risk level in terms of sustainability[1]. From this perspective it is crucial to identify, for the purposes of an overall evaluation, how the measures adopted or planned by the government will affect the revenue and expenditure balance in the long-term and whether it is possible to expect the long-term sustainability to improve at least to the medium-risk level.

- The approved Stability Programme is based on the expected deficit of 9.9% of GDP[2] for 2021, which the CBR describes as the upper limit with room to absorb the impacts of the second wave of the pandemic seen at the beginning of this year, as well as any potential negative shocks resulting from the third pandemic wave. Considering the most recent estimate of the pandemic and macroeconomic development, the CBR estimates the deficit at 7.9% of GDP.

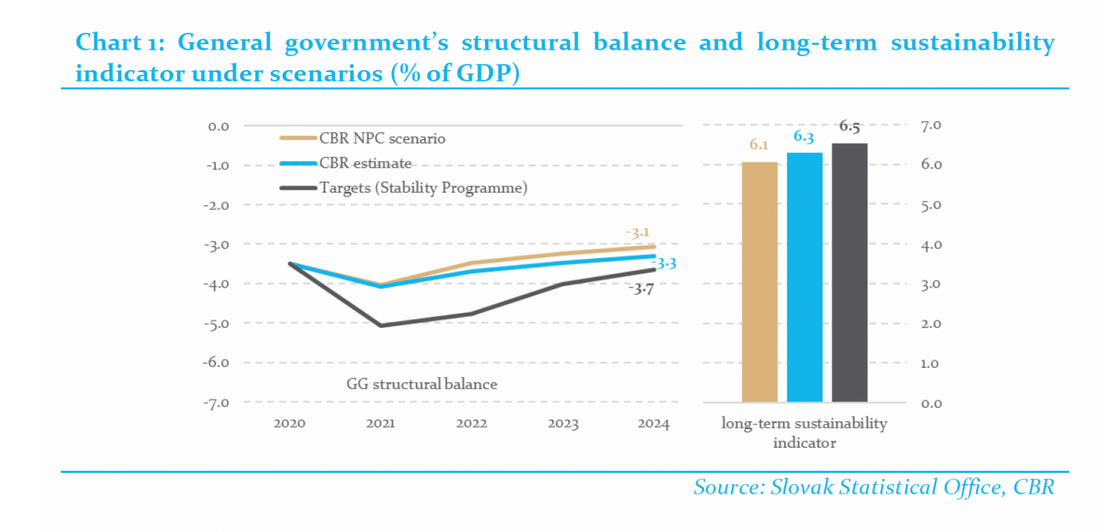

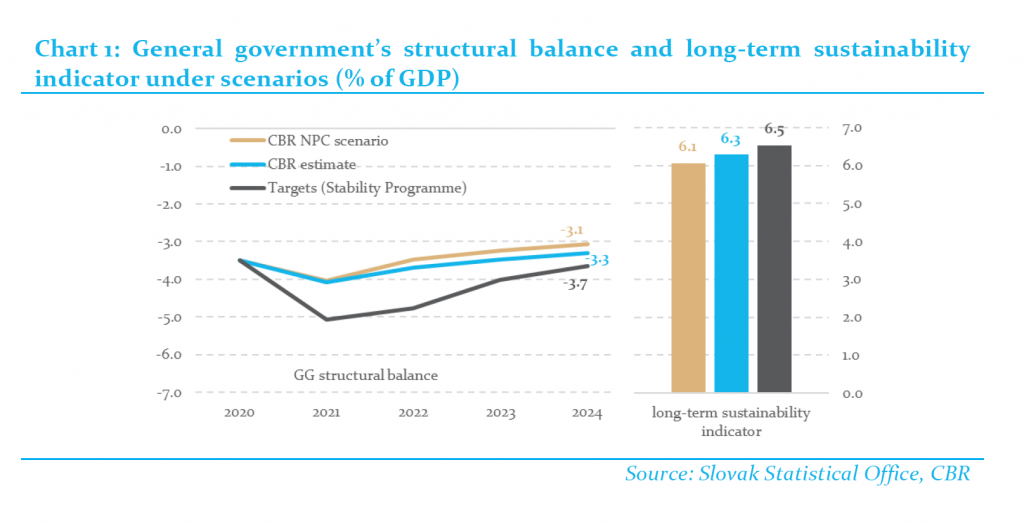

- The CBR expects that, without any additional measures, the deficit after 2021 would be automatically improving to roughly 3.7% of GDP in 2024[3]. In order to improve the long-term sustainability only through consolidation, it would be necessary to keep deficits below such assumed adjustment path. The approved Stability Programme has no such ambition. Taking into account the measures specified in the Stability Programme (without the adoption of the pension reform), the CBR estimates that the long-term sustainability would deteriorate by 0.2% of GDP to 6.3% of GDP. If the objectives set by the government are met, the deterioration of the long-term sustainability would be more significant, reaching at least 0.5% of GDP[4].

- The government’s consolidation effort is insufficient. The Council considers it desirable and achievable for the government to squeeze the deficit below 3% of GDP by the end of its election term, while at the same time bringing the long-term sustainability safely into the medium-risk zone. This would require adopting measures in a total amount of 2.3% of GDP and reducing the long-term sustainability indicator to some 4% of GDP. To achieve this objective, the government has several options available. The entire improvement can either be achieved by reducing the budget deficit or by adopting other measures with a long-term effect that would improve the revenue and expenditure balance in the future, in particular through the announced pension reform on the expenditure side. This recommendation would also be in line with the discussed amendment of the constitutional Fiscal Responsibility Act.

- The favourable macro-economic development expected in 2022 and 2023, along with the high initial structural deficit, exacerbates the need for a gradual adoption of consolidation measures already during the post-crisis year of 2022, at a level of 0.5% of GDP. In 2023, the budget consolidation could reach at least 1% of GDP without compromising economic growth. Despite the restrictive budgetary policy, the fiscal stimulus during the inevitable consolidation could be fuelled, along with intensified drawing of regular European funds under the programming period that is nearing its end, also by new resources from the Next Generation EU recovery fund.

- In order to achieve a medium-risk level of sustainability, it is necessary to continue the recovery of the public finances also in 2024; however, unlike in 2022 and 2023, the immediate improvement of the balance could be partly or wholly replaced by improving the long-term sustainability of the pension system in a manner announced by the government in the Stability Programme and in Slovakia’s recovery and resilience plan. Nonetheless, the draft constitutional act amending the pension system[5], as submitted to a legislative process of the Ministry of Labour, Social Affairs and Family of the Slovak Republic[6], improves the long-term sustainability only at half the rate declared in Slovakia’s recovery and resilience plan, therefore the remaining portion should be covered by deficit consolidation at a level of 1% of GDP also in 2024, unless a “fully-fledged” pension system reform takes place.

- The Council views as negative that, in the Stability Programme, the government has not outlined a clear strategy for reducing the structural deficit in the future, i.e. one that is supported by specific measures. Considering the period necessary for the preparation and implementation of specific measures, it is advisable that such measures be presented as soon as possible. The pandemic itself cannot be a reason justifying the absence of such structural measures, because any potential support to the economy can always be addressed by temporary and, if necessary, more robust measures, or by shifting future investments into the present.

- In the case of a better-than-expected economic development, all positive aspects (including the unspent part of the reserve to address the impacts of the pandemic) need to be strictly reflected in the improvement of fiscal performance. As with 2020, additional room for expenditures allowed by the state budget amendment approved in May 2021 should thus not be used for additional measures that are increasing the structural expenditures in the long-term.

[1] CBR, Report on the Long-term Sustainability of Public Finances as at 18 May 2021 (June 2021)

[2] The government has not published the updated estimate or objective following the approval of the state budget amendment by the parliament. With a purely mechanical calculation, additional changes in the amendment (beyond the version approved by the government) could increase the government’s estimate from 9.9% of GDP to 10.3% of GDP.

[3] This development of the deficit in the medium-term horizon corresponds to the long-term sustainability indicator at 6.1% of GDP, which reflects the legislation as at 18 may 2021.

[4] If the objectives are achieved by one-off measures rather than by improving the structural deficit, sustainability would worsen by some 1 p. p. to 7% of GDP.

[5] Considering the previous frequent changes in the pension system, it would be advisable that a comprehensive pension reform improving the sustainability of public finances is approved by means of a constitutional act.

[6] https://rokovania.gov.sk/RPO/Material/2333/1 (available in Slovak only)