Key conclusions and recommendations

The previous government submitted the Stability Programme of the Slovak Republic for years 2023-2026 (SP), in which it presented an updated fiscal framework of the general government for the upcoming period. It provides information on the direction of the government’s fiscal policy, sets the target values for the general government deficit for the period covered, and quantifies the measures the government expects to be taken to meet the declared budgetary objectives.

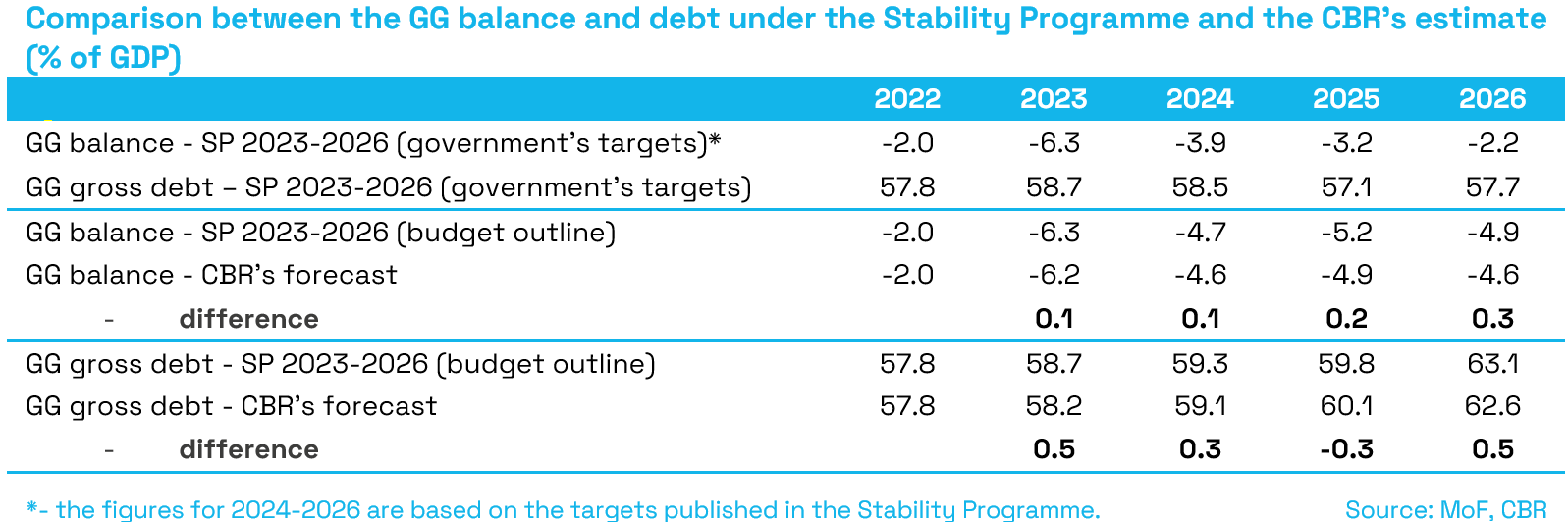

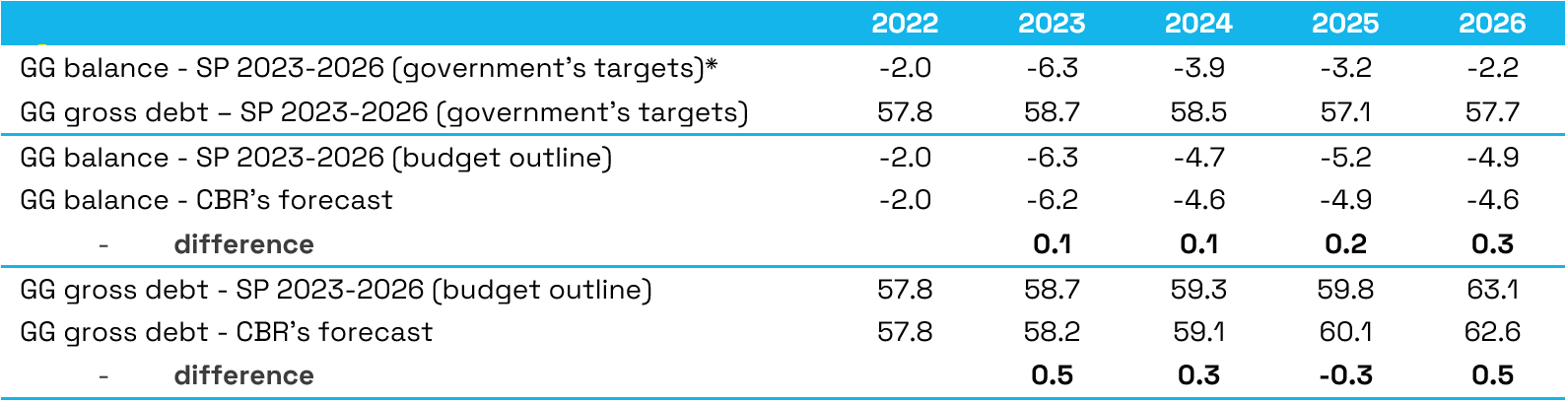

Compared to the originally budgeted general government deficit of 6.4% of GDP in 2023, the government currently estimates a slight decline in the deficit to 6.3% of GDP. In 2024, the fiscal framework (i.e., the budgetary path without additional measures) foresees a year-on-year reduction in the deficit to 4.7% of GDP. However, the government intends to achieve lower deficits of 3.9% of GDP in 2024, 3.2% of GDP in 2025 and 2.2% of GDP in 2026, but no measures have been prepared yet for these years to achieve presented targets.

The budget proposal (without additional measures) foresees an increase in the gross debt from 58.7% of GDP in 2023 to 59.3% of GDP in 2024, followed by a further increase to 59.8% of GDP at the end of 2025 and 63.1% of GDP at the end of 2026. The increase is mainly driven by the high deficits expected in the near term. Assuming that budgetary targets would be met, which are at the moment not backed by any measures, the gross debt would start to decline slightly after 2023, reaching 57.7% of GDP at the end of 2026. Irrespective of the targeted discontinuation of debt growth after 2023, the fact remains that debt has stayed above the upper limit of the sanction brackets under the constitutional Fiscal Responsibility Act since 2020 and, according to the Ministry of Finance, it will remain above this limit throughout the entire forecast period. Because the upper limit is decreasing at a rate of 1% of GDP per year, a stabilised debt would also mean moving away from the upper limit.

Comparison between the GG balance and debt under the Stability Programme and the CBR’s estimate (% of GDP)

*- the figures for 2024-2026 are based on the targets published in the Stability Programme

Source: MoF, CBR

The purpose of opinions of the Council for Budget Responsibility (CBR, the Council) is to provide an independent view on the budgetary assumptions presented in the Stability Programme and to assess whether the current fiscal policy configuration is sufficient in terms of achieving the targets set, while identifying potential risks that would need to be subsequently eliminated through the adoption of additional measures. In line with its mandate, the CBR also assesses whether the current budget creates the conditions to ensure the long-term sustainability of public finances and to comply with national fiscal rules. To that end, the CBR wishes to highlight the following key conclusions from its evaluation:

- The year 2023 is the baseline year for establishing the fiscal framework of the Stability Programme for 2023-2026. If no additional measures are adopted by the end of the year, the deficit could reach 6.2% of GDP in 2023, according to the Council. This represents a slightly better starting position (by 0.1% of GDP) for the 2023-2025 period than currently estimated by the government. The positive risk is mostly associated with the overestimated spending of current and capital expenditures and co-financing expenditure in the government’s estimate compared to actual developments.

- In the medium term, as long as the existing policies[1] remain unchanged, the CBR estimates the deficit to reach 4.6% of GDP in 2024, 4.9% of GDP in 2025 and 4.6% of GDP in 2026. Compared with the estimates in the Stability Programme, the deficit levels are lower by 0.1% of GDP to 0.3% of GDP. When assessed against the declared targets, the government thus lacks specific measures amounting to 0.7% of GDP in 2024, 1.7% of GDP in 2025 and 2.4% of GDP in 2026.

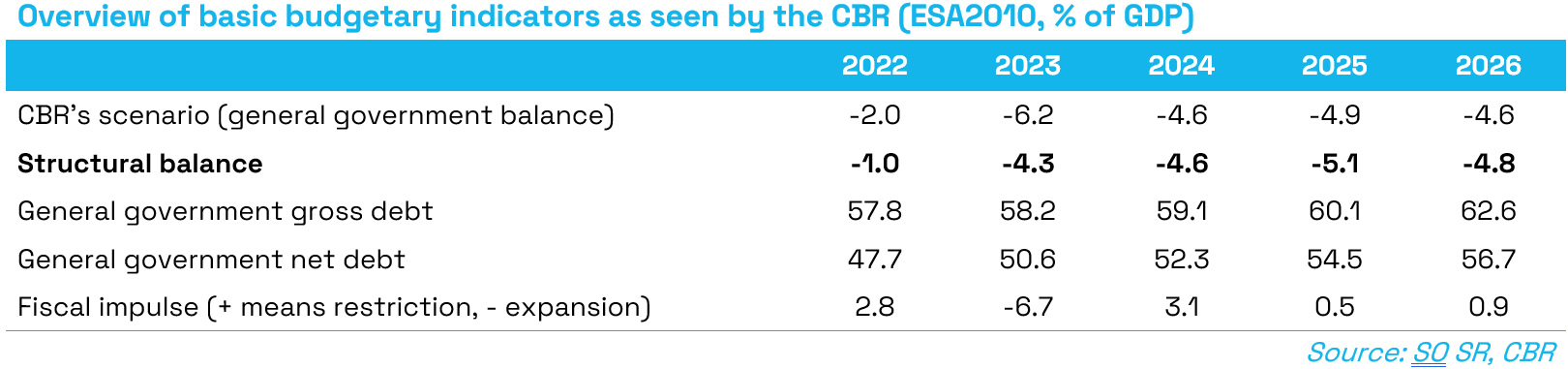

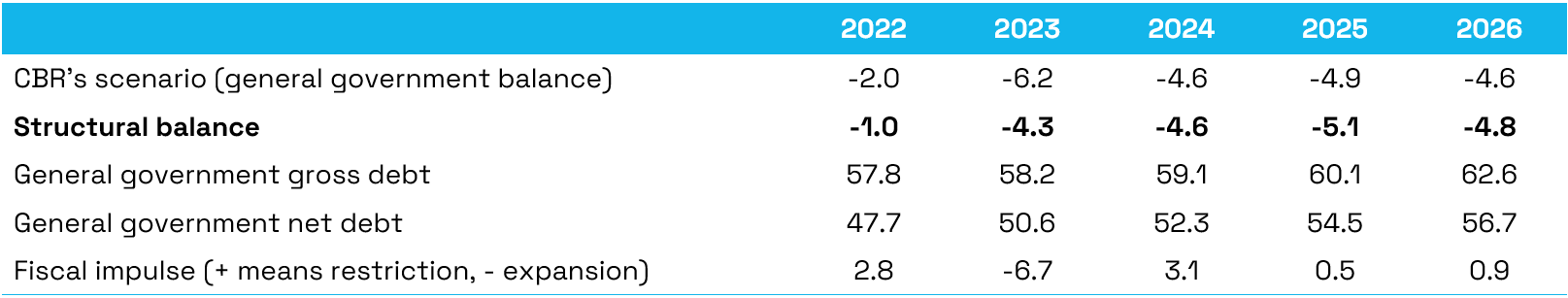

- The unfavourable macroeconomic environment has necessitated the adoption of a number of measures to cushion the impacts of the crisis and support the economy, as also reflected in the fiscal performance of the general government. The structural deficit will reach as much as 4.3% of GDP in 2023, thus deteriorating by 3.2% of GDP compared to 2022, mainly due to the delayed indexation of expenditure, measures adopted in 2022 (effective from 2023) and the lasting impact of the security and energy crisis. Over the next three years (2024-2026), the structural deficit remains at levels that are still high and is projected to reach 4.8% of GDP in 2026.

- Based on the estimated developments in general government balance, the CBR expects that the gross debt could reach 58.2% of GDP in 2023, an increase of more than 0.4 p.p. year-on-year. In the following years, it would increase further to 62.6% of GDP by the end of 2026, also due to the estimated high deficits. Taking into account the gradual decrease in the thresholds of sanction brackets, this would imply that the debt would remain above the upper limit of the debt brake by more than 11 p.p. in 2026. Net debt would reach 50.6% of GDP at the end of 2023. Due to the lack of consolidation measures at the end of the medium-term horizon (end of 2026), the CBR expects the net debt to gradually increase to 56.7% of GDP.

Overview of basic budgetary indicators as seen by the CBR (ESA2010, % of GDP)

Source: SO SR, CBR

- The accelerated absorption of EU funds in 2023 should support economic growth, thereby compensating for the unfavourable macroeconomic environment. The aforementioned deterioration in the structural balance will also contribute significantly to the fiscal expansion in 2023, which increases the risks related to sustainability in the future. Therefore, the consolidation of public finances is essential in the upcoming period. The proper timing of the absorption of EU funds could mitigate the necessary restrictive configuration of the fiscal policy. The funds from the Recovery and Resilience Plan could potentially provide a stimulus to the economy by compensating and partly eliminating the expected shortfall in EU funds due to the start of the new programming period.

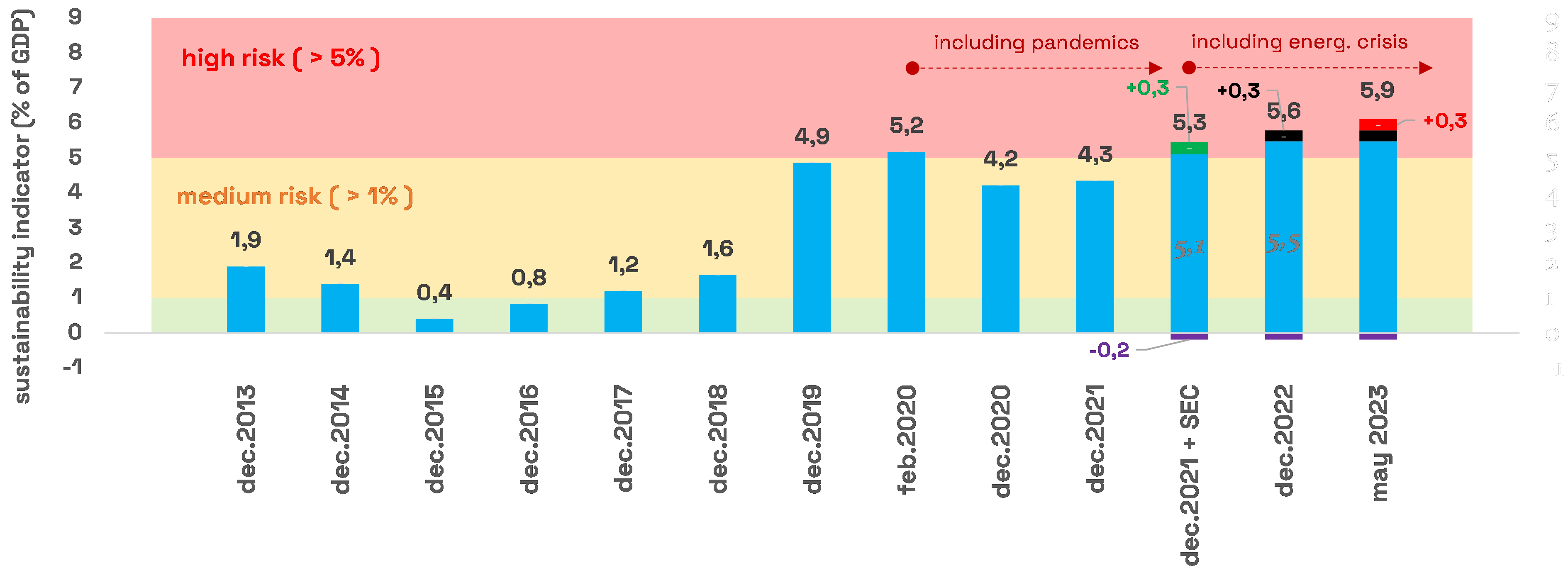

- The developments in public finances expected by the Council between 2023 and 2026 will worsen long-term sustainability by 3% of GDP compared to the estimated level at the end of 2022. This is due to effect of newly adopted measures (0.3% of GDP). Long-term sustainability would thus move deeper into the high-risk zone, with the long-term sustainability indicator reaching 5.9% of GDP. This means that a permanent revenue increase and/or expenditure reduction of EUR 7.6 billion would be needed in order to achieve long-term sustainability of public finances.

Long-term sustainability indicator (% of GDP) *

The blue bars represent the values of the long-term sustainability indicator taken from the 2022

Long-term Sustainability Report published in April 2023. The coloured contributions represent

additional adjustments due to updated assumptions[2] or the adoption of new legislative measures in 2023.

SEC – security and energy crisis

Source: CBR

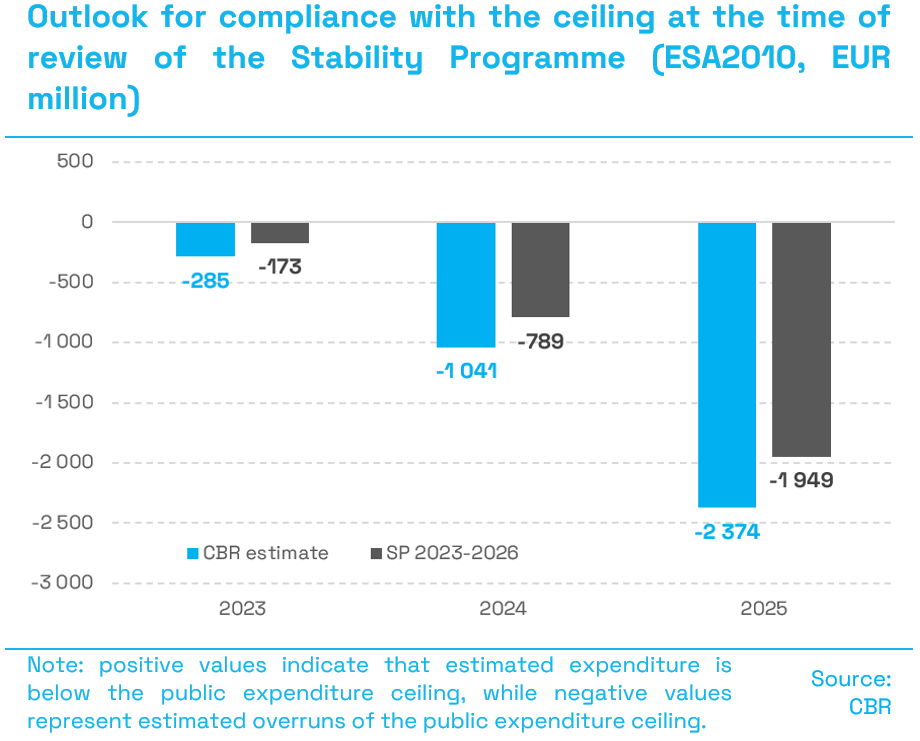

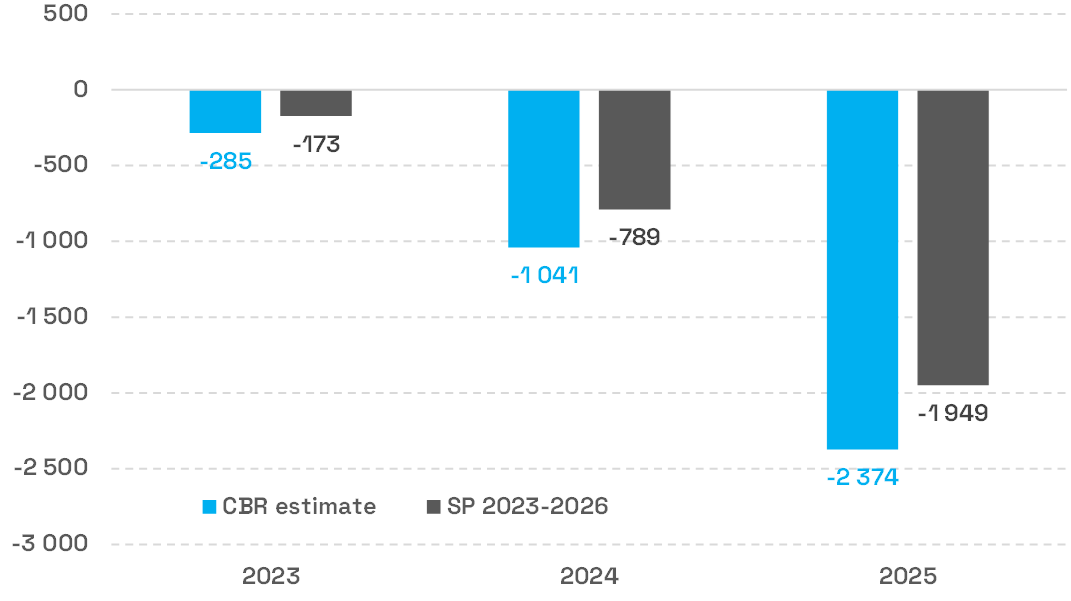

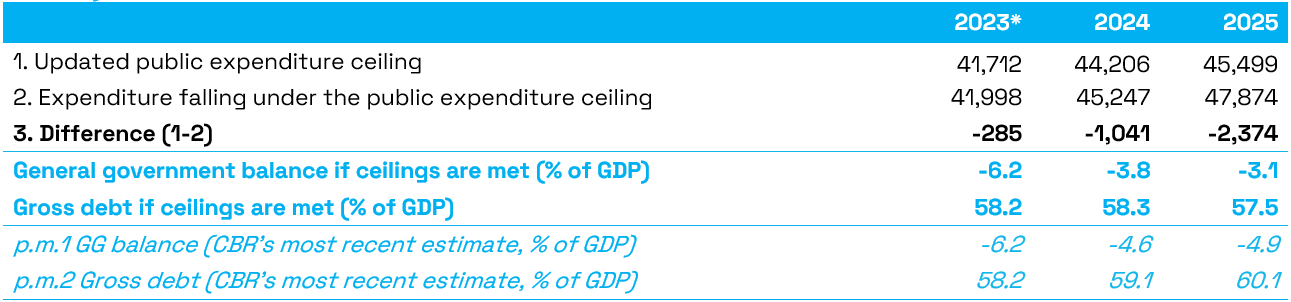

- The CBR estimates that consolidation measures amounting to EUR 285 million would be required in 2023 to comply with the expenditure ceilings approved by the parliament. In 2023, due to the applicability of the general escape clause, the government is exempted from the obligation to adjust the general government budget to the approved ceiling, but this exemption is to expire by the end of the year. The need for consolidation measures is estimated at EUR 1 billion in 2024 and increases by a further EUR 1.3 billion to almost EUR 2.4 billion[3] in 2025. Compared with the measures quantified by the Finance Ministry when the General Government Budget for 2023-2025[4] was approved, the magnitude of the required measures has increased mainly due to the adoption of several measures that worsen the general government balance in 2023 without adequately offsetting their effects[5], as well as due to ongoing risks to the budget which are still identified[6] by the Council.

- Due to budgetary risks, the CBR currently estimates a higher need for measures required each year to comply with the ceilings when compared to the figures in the Stability Programme. These include, in particular, higher estimated expenditure on health and social transfers, an estimated increase in wage expenditure in the state budget and, to a lesser extent, higher estimated current expenditures of state-owned companies (National Motorway Company (NDS), railway companies ŽSR and ŽSSK), which are partly offset by lower investment.

Outlook for compliance with the ceiling at the time of review of the Stability Programme (ESA2010, EUR million)

Note: positive values indicate that estimated expenditure is below the public expenditure ceiling,

while negative values represent estimated overruns of the public expenditure ceiling.

Source: CBR

- Adherence to the public expenditure ceilings in 2024 and 2025 would reduce the deficit to 3.1% of GDP in 2025 and the projected gross debt by 2.5 p.p. to 57.5% of GDP at the end of 2025. This would move the long-term sustainability of public finances into the medium-risk zone, with the debt level still remaining above the upper limit of the debt brake (by 5.5 p.p.).

Measures needed to comply with the public expenditure ceiling against the CBR’s scenario (in EUR million)

* For 2023, an exemption from complying with the ceiling applies; therefore, in its calculations,

the CBR does not consider that it will be complied with.

Source: CBR

Although the government’s medium-term budgetary targets are broadly in line with the applicable ceilings and also reflect the forthcoming change in the European fiscal rules, meeting these targets would probably not be sufficient to bring the debt below the highest sanction bracket of the debt brake. This implies that, after the expiry of the next 24-month exemption from the application of more stringent sanctions, which will be granted to the government following the vote of confidence, an unchanged debt brake will require an even stronger consolidation of public finances in the future, unless the debt brake mechanism is modernised.

- The 24-month exemption from the obligations to be met when exceeding the highest sanction brackets of the debt brake, granted to the previous government in 2021 after the approval of its manifesto and the vote of confidence, expired on 5 May 2023. This was followed by the commitment of 3% of the statutory expenditure of the state budget for 2023. The commitment of EUR 709 million in expenditure did not improve the estimate of the general government balance[7] or reduce the debt; therefore, this sanction does not fulfil the purpose envisaged by the constitutional Fiscal Responsibility Act.

- If the parliament does not approve the new government’s manifesto and does not express confidence in the new government, the government will be subject to the sanctions resulting from exceeding the highest brackets of the constitutional Fiscal Responsibility Act. In particular, the government would be required to present to the parliament in the autumn a balanced or surplus budget for 2024.

- The Council considers it positive that the new government has communicated the preparation and presentation of consolidation measures in public finances as a priority. In the medium term, the CBR believes that stabilising the debt and creating the conditions for its further reduction by strictly adhering to the expenditure ceilings, as well as bringing the high risk for long-term sustainability safely to the medium risk zone, should continue to remain the main objective of the government. This underlines the need for future budgetary policy makers to start publicly communicating credible proposals for the recovery of public finances in a volume of some EUR 1 billion in 2024 and an additional EUR 1.3 billion in 2025.

[1] The so-called “most-likely” scenario of the CBR.

[2] In addition to refining the estimated impact of energy prices on general government expenditure (a positive effect of 0.2% of GDP), the macroeconomic impact of the security and energy crisis has been revised (a negative effect of 0.3% of GDP) and the estimate of tax revenues has also been updated (a negative effect of 0.3% of GDP). Overall, the CBR estimates that the security and energy crisis has contributed to the worsening of the long-term sustainability indicator by 0.9 p.p.

[3] Compared to the draft budget based on the stability programme, this would amount to EUR 173 million in 2023, EUR 789 million in 2024 and EUR 1.9 billion in 2025, assuming that the financing of the effects of the approved advance indexation of pensions and parental allowance is included in the fiscal framework.

[4] Information on the relationship between the approved public expenditure ceiling and the general government budget for 2023-2025, approved by the Government of the Slovak Republic on 17 January 2023. As quantified by the Ministry of Finance, the approved budget for 2023 is in line with the ceiling (budgeted expenditure is EUR 7 million below the ceiling). In order to comply with the ceiling in 2024 and 2025, the Ministry of Finance indicated that the budget lacked measures worth EUR 360 million and EUR 928 million, respectively.

[5] These include, in particular, the abolition of TV/radio licence fees, changes to car registration fees, the extension of free school meals, the allowance for health and social services workers and changes to parental allowance.

[6] Especially in areas falling under the expenditure ceilings. On the contrary, in other parts of the budget (such as co-financing expenditure related to the absorption of EU funds), the Council sees positive risks to the budget.

[7] Funds have been committed for the financial support to state corporations, with no impact on the general government balance according to ESA 2010 methodology, as stated in the budget.