The structural deficit reached 3.8% of GDP in 2020, having deteriorated by 0.4% of GDP year-on-year when taking into account unexpected revenue shortfalls. The expenditure growth rate significantly outpaced the potential economic growth and contributed to a deterioration of the deficit by 1.2% of GDP.

The declaration of exceptional circumstances has temporarily suspended the application of the correction mechanism adopted by the government in January 2020, based on which a balanced budget was supposed to be attained in 2020. In 2021, the economic situation in Slovakia has improved and the most recent forecasts expect the Slovak economy to grow. For this reason, the government approved the end of the duration of exceptional circumstances as at 30 June 2021 which, according to the CBR, means that, considering the condition of public finances, the correction mechanism should be triggered again after this period. The correction mechanism should consist in setting a public expenditure ceiling as from 2022 for the entire duration of the correction. It will take into account the adjustment path towards the structural balance improvement determined by the government and the fulfilment of the medium-term budgetary objective based on the updated estimate of the structural deficit for 2021, which the CBR currently estimates at 3.7% of GDP. Considering the positive economic development, the CBR would prefer consolidation to commence as from 2022.

However, along with ending the exceptional circumstances, the government also decided not to trigger the correction mechanism even in 2022, referring to non-application of the Stability and Growth Pact by the European Commission due to exceptional circumstances. Ending the exceptional circumstances without the Ministry of Finance subsequently submitting a proposal to trigger the correction mechanism is, according to the CBR’s opinion, in conflict with the balanced budget rule and the correction mechanism principles, because the obligation not to apply the correction mechanism is only imposed throughout the duration of exceptional circumstances which ended this year. The government may decide not to apply the correction mechanism, but its decision must be preceded by the correction mechanism proposal of the Ministry of Finance.

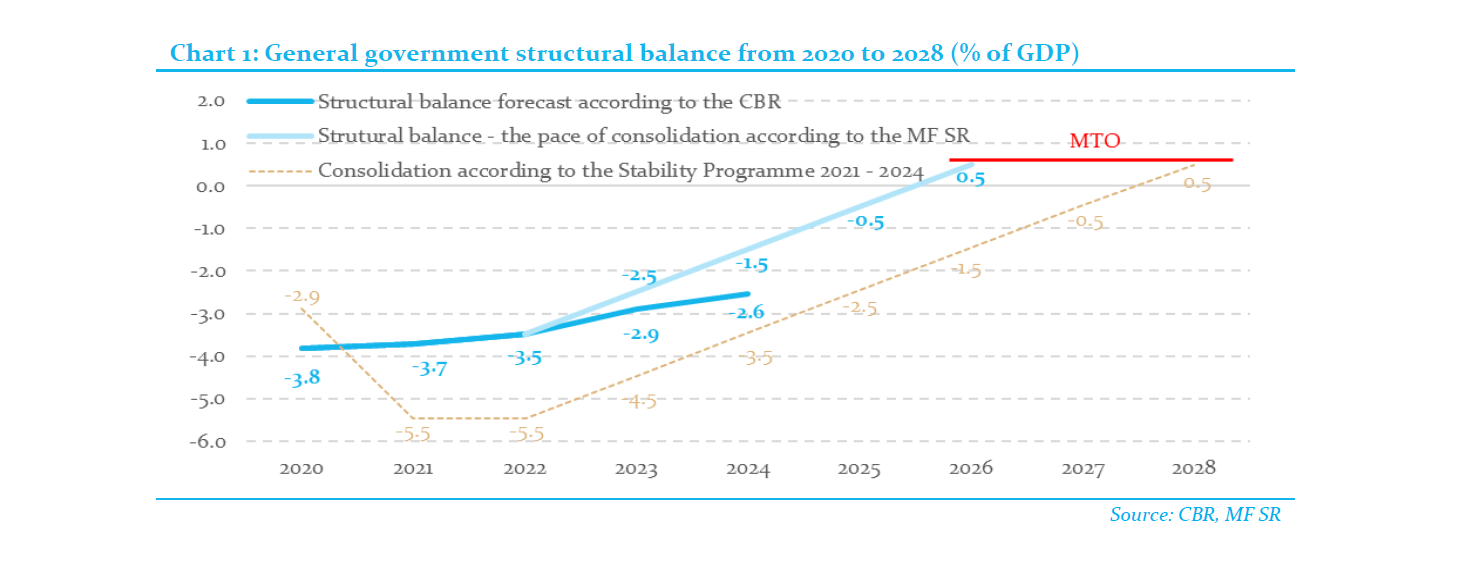

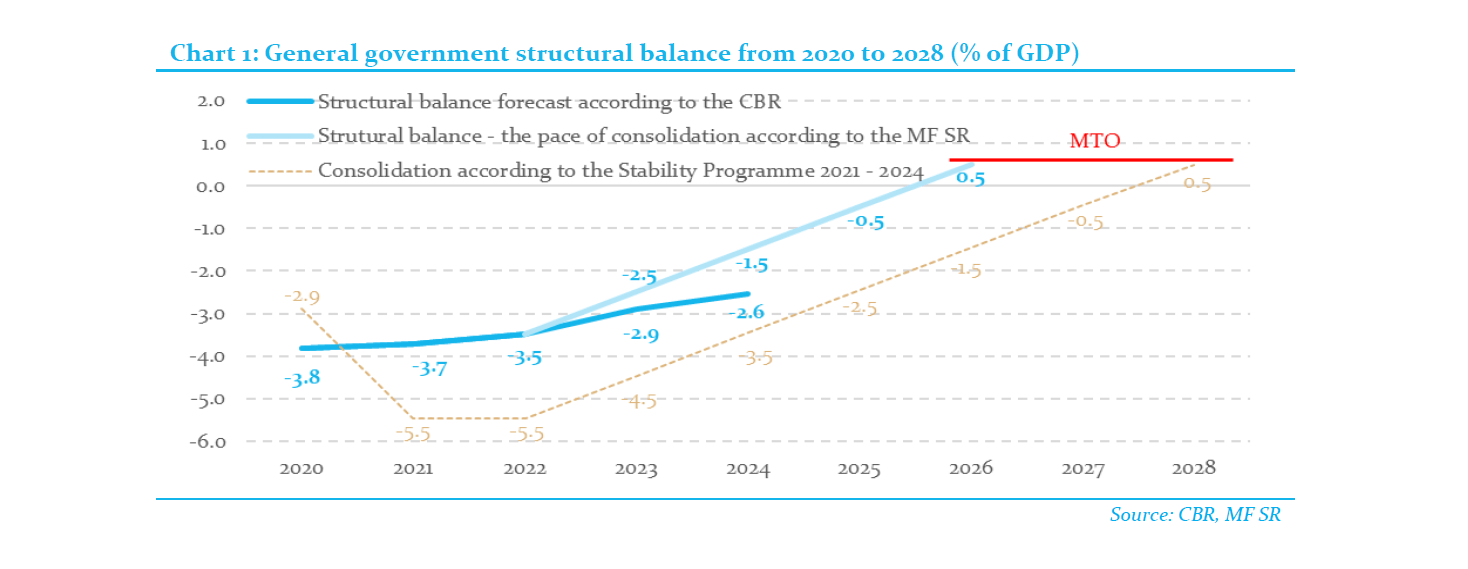

Taking into account the current developments in public finances in 2021, the medium-term tax revenue forecasts and the government-planned improvement of the structural balance, the CBR estimates that a structural surplus of 0.5% of GDP, as a new medium-term objective of the government, should be achieved in 2026 (Chart 1), i.e., two years earlier than planned by the government in the Stability Programme. In the event that a significantly lower deficit in 2021 materialises (i.e., the continuing improvement of the economic situation and the absence of significant negative impacts of the third wave of the pandemic on Slovakia’s economy), the government should apply its consolidation plans based on the adjustment path “Structural balance – the pace of consolidation according to the Ministry of Finance” as presented in the above chart, because this will constitute the basis for the ex-post evaluation.

Even though the level of the medium-term objective set by the government is stricter than the minimum value required by the rule, achieving a budget with a slight surplus would not suffice in terms of the long term sustainability of public finances, unless significant structural reforms in areas sensitive to population ageing are implemented simultaneously. Without implementing such reforms (in particular the pension system, the provision of healthcare and long-term care services) and without increasing the competitiveness and productivity in other sectors of the Slovak economy, a structural surplus of around 2% of GDP would be necessary in order to significantly push the long-term sustainability risks down to the low-risk zone.