The government has approved the 2024-2027 Stability Programme of the Slovak Republic in which it has specified deficit targets of the general government for the upcoming period and also presented an updated fiscal framework for the general government (i.e., budgetary development without additional measures). The document provides information on the direction of fiscal policy and the amount of the measures, as envisaged by the government, that must be taken to meet the declared budgetary objectives.

Key conclusions and recommendations

- According to the Council, the general government deficit will amount to 5.7 % of GDP in 2024, which represents an increase by 0.8 p.p. against the 2023 level.

- If the deficit is kept at 5.9 % of GDP as planned by the government, the long-term sustainability of Slovakia’s public finances will deteriorate in 2024.

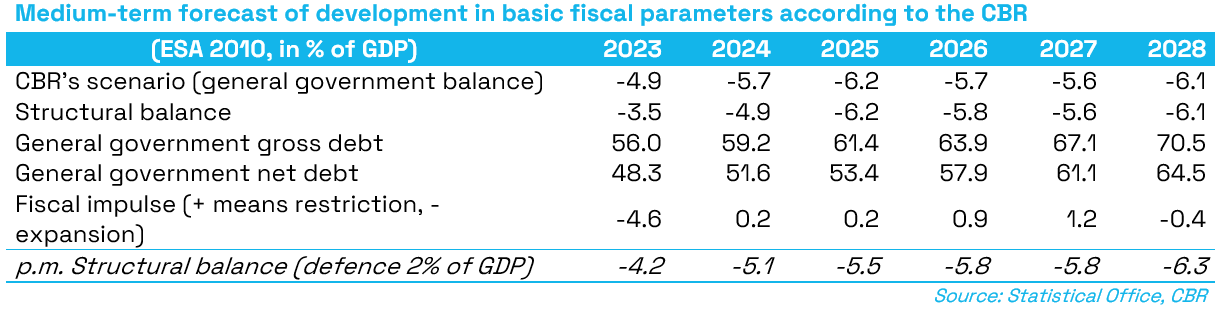

- If no additional measures are adopted, the deficit will not fall below 5.6 % of GDP by 2028. This would result in a dynamic increase in the gross debt to as much as 70.5 % of GDP in 2028.

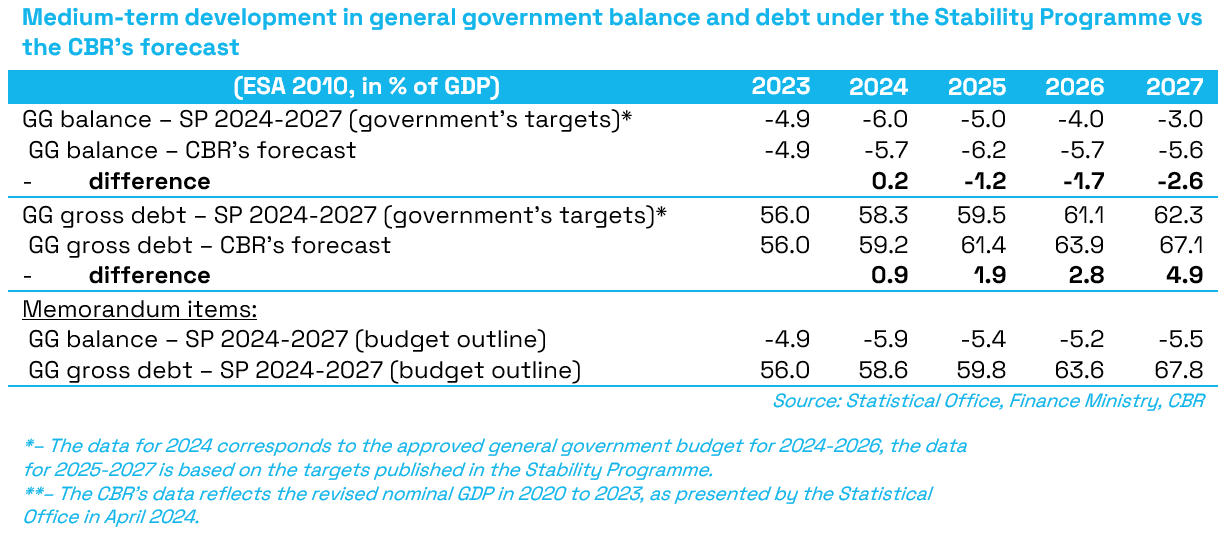

- According to the CBR, the target deficits set by the government of the 2025-2027 period are not supported by particular measures in the amount of 1.6 bn to 4.0 bn euros (1.2 % of GDP to 2.6 % of GDP).

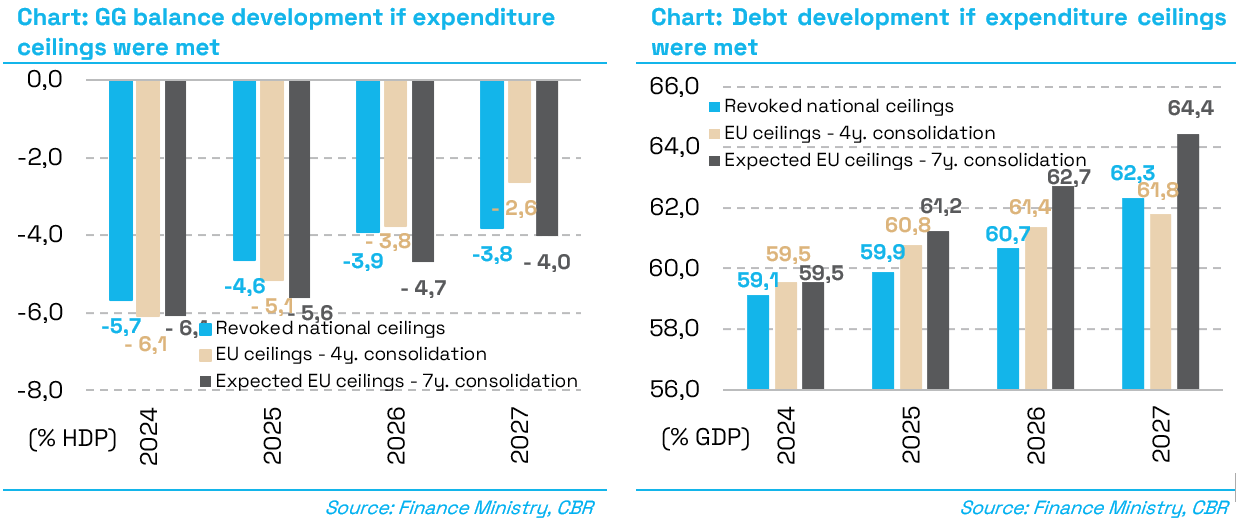

- Under the new rules on public expenditure ceilings, no additional consolidation is required in 2024; consolidation under the new rules will start only in 2025 and require the adoption of measures amounting to between 2.3 bn and 4.3 bn euros (1.5 % of GDP to 2.8 % of GDP) by 2027.

The government has approved the 2024-2027 Stability Programme of the Slovak Republic in which it has specified deficit targets of the general government for the upcoming period and also presented an updated fiscal framework for the general government (i.e., budgetary development without additional measures). The document provides information on the direction of fiscal policy and the amount of the measures, as envisaged by the government, that must be taken to meet the declared budgetary objectives.

The medium-term budgetary objectives proposed by the government envisage a reduction in the general government deficit at a rate of 1 % of GDP per year to gradually reach 3.0 % of GDP, but the Stability Programme lacks specific measures to fully achieve these targets. Under the fiscal framework, the deficit will decrease from 5.9 % of GDP in 2024 mainly due to the abolition of energy subsidies; without additional measures, the deficit will remain, according to the government, at the levels from 5.2 % of GDP to 5.5 % of GDP throughout the 2025-2027 period.

The budget proposal (without additional measures) projects gross debt to increase from 58.6 % of GDP in 2024 towards 67.8 % of GDP at the end of 2027. The increase is mainly driven by the high levels of deficits expected in the near term. Assuming that the budgetary objectives are met, gross debt would be growing at a slower pace after 2024, reaching the level of 62.3 % of GDP at the end of 2027. Notwithstanding the targeted reduction in debt growth after 2024, the debt has since 2020 been above the upper limit of the sanction threshold under the constitutional act, and the Finance Ministry expects it to remain above this limit throughout the entire forecast period. Given that the upper limit decreases at a rate of 1 % of GDP per year, even if debt was stabilised, it would be moving away from the upper limit.

The purpose of the opinion prepared by the Council for Budget Responsibility (CBR, Council) is to offer an independent view on the fiscal assumptions presented in the Stability Programme and to assess whether the current fiscal policy setup is sufficient in terms of achieving the targets set, while identifying those potential risks which need to be eliminated through the adoption of additional measures. In accordance with its mandate, the CBR also assesses whether the current budget creates the conditions to ensure the long-term sustainability of public finances and compliance with national fiscal rules. In this context, the CBR wishes to highlight the following main conclusions from its assessment:

- The year 2024 is a baseline year for the preparation of the fiscal framework under the Stability Programme for the 2024-2027 period. According to the Council, the general government deficit could reach 5.7 % of GDP (7.4 bn euros) in 2024, a year-on-year increase of 0.8 p.p. of GDP. Compared with the government’s current estimate, this gives a slightly better starting position (by 0.2 % of GDP) for the 2025-2028 period. The positive derogation from the government’s estimate is mainly due to a decrease in state budget expenditure spending coupled with better fiscal performance of other entities.

- For the medium-term development with preserving the existing policies, the CBR expects the deficit to amount to 6.2 % of GDP in 2025, followed by a moderate decline to 5.7 % of GDP and 5.6 % of GDP in 2026 and 2027, respectively, and a subsequent increase to 6.1 % of GDP in 2028. Compared with the projections under the Stability Programme, these deficit levels are between 0.1 % and 0.7 % of GDP higher.

- If the government’s declared target of reducing the deficit to the 3 % of GDP level by 2027 was achieved, the long-term sustainability of public finances would improve and move to the medium-risk zone. However, according to the CBR, the government lacks specific measures amounting to 1.2 % of GDP in 2025, 1.7 % of GDP in 2026, and 2.6 % of GDP in 2027, which are needed to achieve said targets. In view of the expiry of the temporary measures after 2027, maintaining the deficit at 3 % of GDP will also require the adoption of further consolidation measures in 2028.

- The adoption of several measures permanently increasing the public expenditure has also been reflected in an outlook for the fiscal performance of general government. The structural deficit will amount to 4.9 % of GDP in 2024, an increase of 1.4 p.p. compared to the 2023 level, mainly as a result of the measures adopted in 2023 and the increased spending on investments in the defence sector and, to a lesser extent, the growing health expenditures. Between 2025 and 2028, the structural deficit will remain at high levels at around 6.0 % of GDP.

- Based on the projected development in the general government balance, the CBR expects the gross debt to amount to 59.2 % of GDP in 2024, which would be an increase of 3.2 p.p. compared to the previous year. In the following years, the gross debt is projected to continue to increase, including due to the estimated high deficits, reaching 70.5 % of GDP at the end of 2028. Taking into account the gradual decrease in the thresholds of sanction brackets, this would mean that the debt would remain well above the upper limit of debt brake at the end of the medium-term horizon, exceeding the upper limit by more than 20 % of GDP. The net debt will be at 51.6 % of GDP at the end of 2024. In the absence of consolidation measures, the CBR expects the net debt to gradually increase to 64.2 % of GDP by the end of the medium-term horizon.

Due to the estimated sharp decline in the spending of EU funds linked to the closing of the previous and the launching of the new programme period, the fiscal policy setup (including the inflow of EU funds) will be slightly restrictive in 2024 despite the ongoing deterioration in the structural balance. In the medium term, the CBR expects the reduced availability of EU funding to have a dampening effect on domestic demand between 2025 and 2027, followed by a fiscal policy easement expected to occur in 2028.

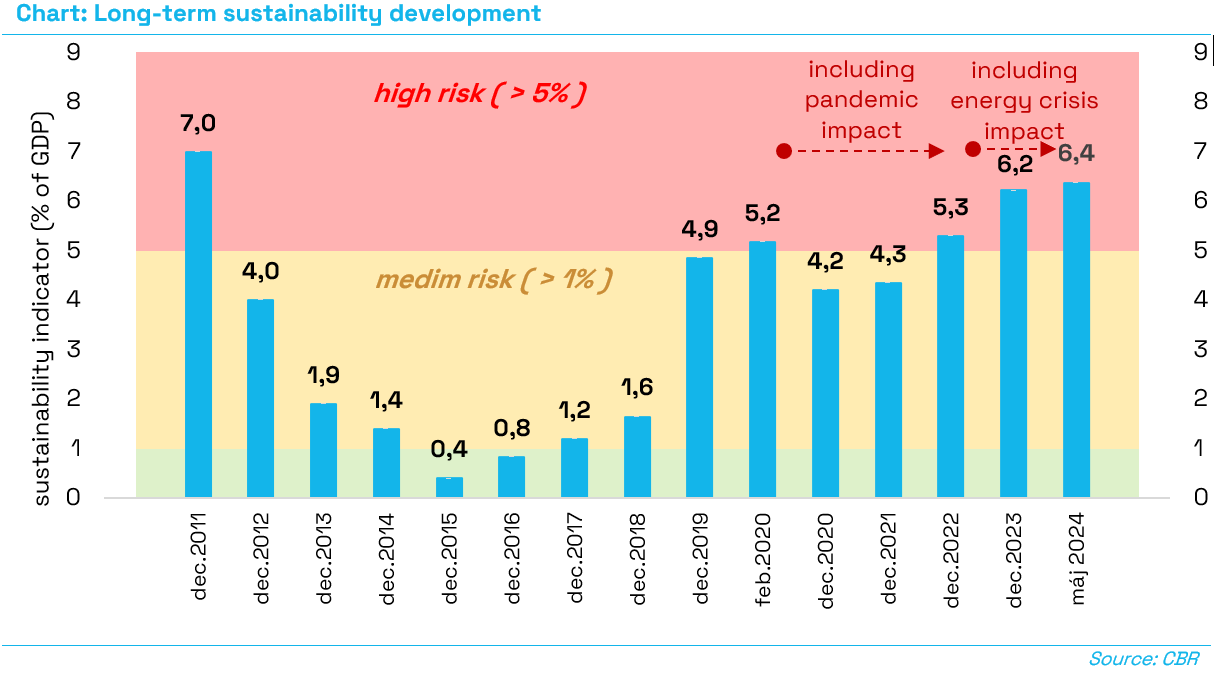

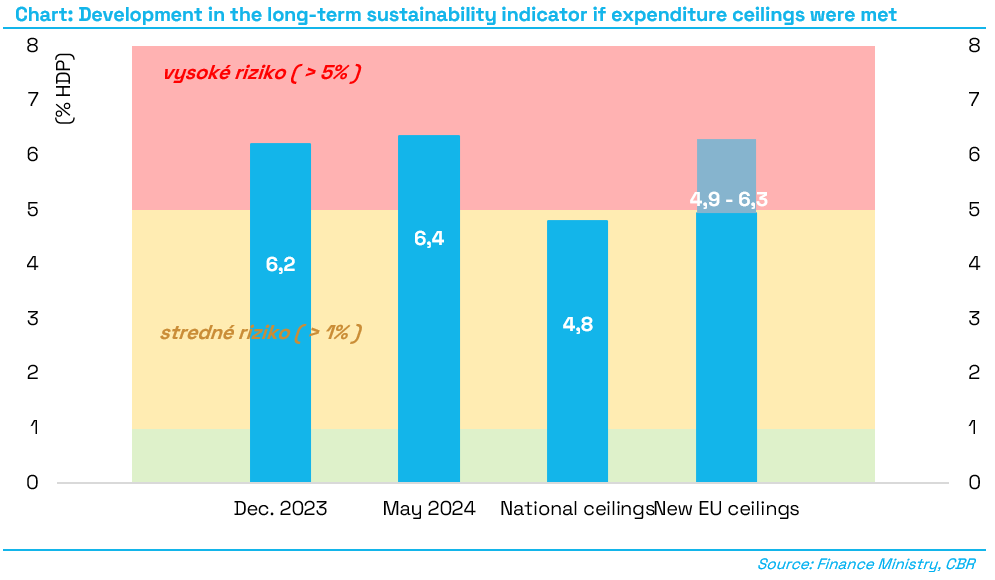

- The development in public finances projected by the Council for the 2024-2028 period under a CBR scenario, i.e., without additional measures, has a negative impact on long-term sustainability of 2 % of GDP compared to the situation estimated at the end of 2023. This is caused by the adopted expenditure-side measures (0.3 % of HDP). The long-term sustainability would thus sink deeper into the high-risk zone, with the long-term sustainability indicator at the level of 6.4 % of GDP. This would require a permanent increase in revenues and/or reduction in expenditure in the amount of 8.3 bn euros.

- The current unfavourable development in public finances requires that consolidation efforts start as soon as possible. The expected strengthening of economic growth, a significant decline in inflation, which will lead to a temporary strong increase in real wages, as well as the gradually recovering external demand also create a favourable environment for consolidation. Since the economy will perform slightly above its potential in the medium term, stronger consolidation efforts above the development currently estimated by the CBR should have no significant impact on economic imbalances. From the perspective of macroeconomic effects of fiscal policy, it is also necessary that the inevitable consolidation of public finances be accompanied by as intensive spending of EU funds as possible.

- Meeting the estimated deficit presented in the Stability Programme would worsen the long-term sustainability by 0.7 % of GDP in 2024. Under the original expenditure ceilings, the changes in the early retirement pensions would require additional consolidation measures in the amount of 0.2 % of GDP to be adopted this year, but the deviation of the government’s estimate from this ceiling amounts to 0.8% of GDP. The European Commission also expects Slovakia’s public finances to deteriorate in the near future; the country’s deficits in 2024 and 2025 could be the second highest in the EU.

- The new public expenditure ceiling rule approved by the National Council of the Slovak Republic on 9 May 2024 does not require any consolidation in 2024; on the contrary, the government could increase the deficit up to 6.1 % of GDP and still be able to comply with the new ceiling, according to the CBR’s estimate. Consolidation under the new rules will begin in 2025 and measures ranging from 2.3 bn euro to 4.3 bn euros will have to be adopted by 2027, depending on whether the European Commission permits to spread the consolidation efforts over a period longer than four years.

- Under the original ceilings, the consolidation would have been required to be evenly spread over the 2024-2027 period; complying with these ceilings would result in a reduction of the deficit to 3.8 % of GDP in the medium-term by 2027, slowing down the growth in gross debt by 4.8 % of GDP compared with the current outlook, to the level of 62.3 % of GDP. The long-term sustainability of public finances would thus move to the medium-risk zone, with the debt remaining above the upper limit of debt break (by 12.3 % of GPD).

- By contrast, consolidation efforts under the new rules are mainly concentrated on the years 2026 and 2027, which also poses a risk from a political cycle perspective. If the consolidation efforts are spread over a seven-year period, which seems very likely, the deficit would decrease at a slower year-on-year rate and the debt would grow faster than under the original rule on public expenditure ceilings.

- At the same time, the new rules do not guarantee that a slowdown in expenditure growth will be fully reflected in a permanent recovery of public finances, as they do not sufficiently distinguish between permanent and temporary measures (e.g. a reduction in contributions to the 2nd pension system pillar, the abolition of energy subsidies or a temporary tax increase). For that reason, the long-term sustainability indicator would be in the range of 4.9 to 6.3 % of GDP[1], depending on the nature of the measures adopted. This means that while compliance with the original expenditure ceilings would have improved the long-term sustainability to the medium-risk zone by 2027, with the new European rules in place, the long-term sustainability is very likely to remain in the high-risk zone based on the current projections.

[1] These are extreme values of the indicator, assuming that the permanent measures improve the long-term sustainability in the same extent (the indicator falls to 4.9 % of GDP, just inside the medium-risk zone), or that the measures have no effect at all over the long-term horizon (the indicator rises to 6.3 % of GDP within the high-risk zone).