Find full text of the Evaluation including attachments under the article in the download section.

The Council for Budget Responsibility (CBR, Council) publishes the evaluation of compliance with the public expenditure ceiling for 2023. This goes in line with the current wording of §30aa (17) and (18) of Act No. 523/2004 Coll. on General Government Budgetary Rules (further referred to as the “Act”), which requires the Council to prepare and publish the evaluation of compliance with the ceiling each year before 15 June, based on the methodology agreed with the Ministry of Finance of the Slovak Republic (MF SR) on 22 December 2022[1].

As the general escape clause was effective in 2023 pursuant to §30aa (22), the government was not required to align the general government budget with the public expenditure ceiling, provided that it does not endanger fiscal sustainability. The evaluation thus serves particularly as an information on the impact of the expenditure subject to the ceiling on long-term sustainability of public finances.

Pursuant to the current wording of §30aa (19) of the Act, if the Council finds that the public expenditure ceiling for 2023 has not been complied with, the government is required to send the parliament a written justification of its non-compliance with the expenditure ceiling for the previous fiscal year[2] within 30 days of the publication of the evaluation.

Council’s procedure in evaluating compliance with the public expenditure ceiling

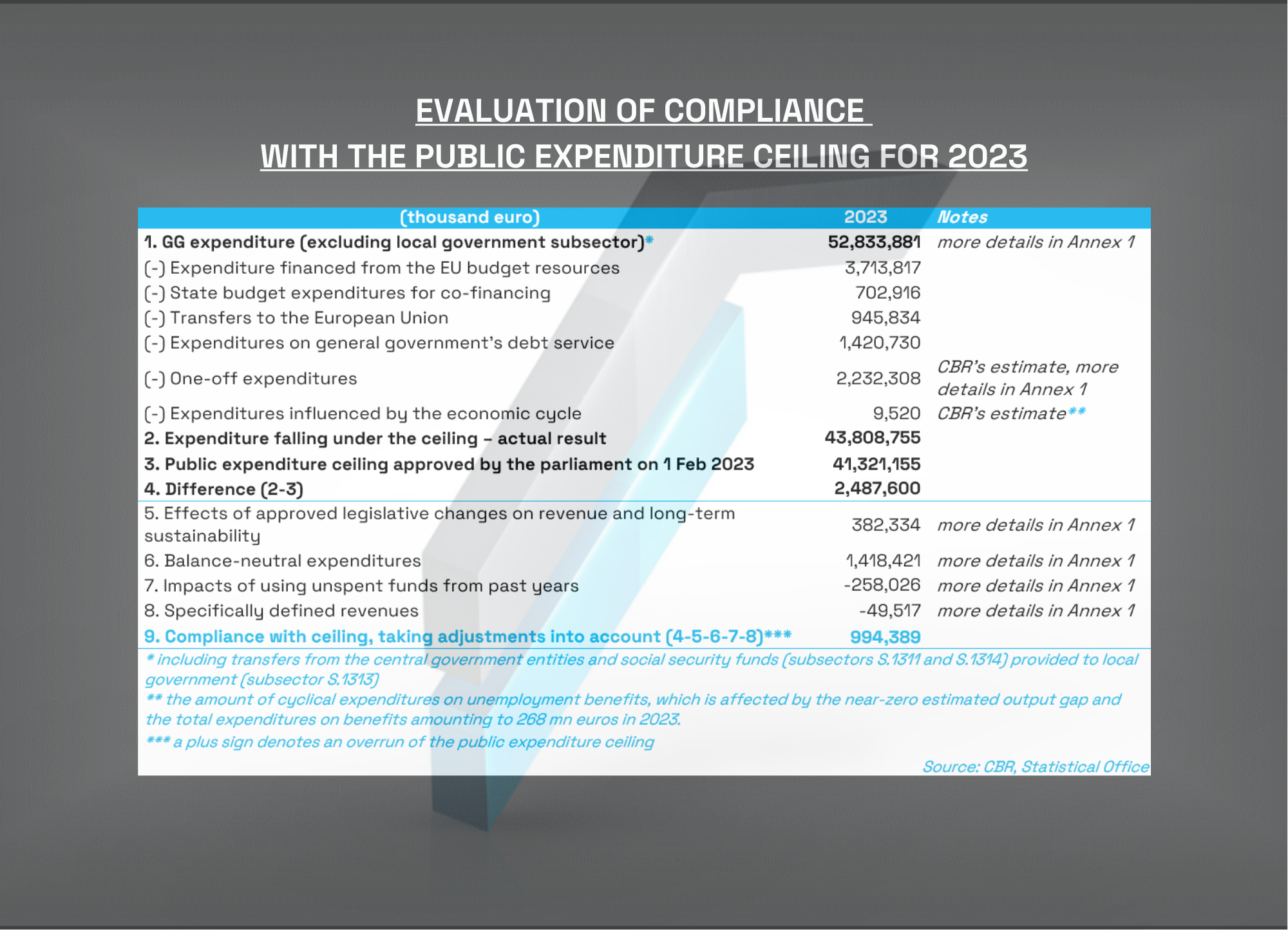

Evaluation of compliance with the public expenditure ceiling is based on the 2023 data from the spring deficit and debt notification published by the Statistical Office of the Slovak Republic on 22 April 2024. Using this data, the Council has quantified the actual expenditure which falls under the ceiling. From the total general government expenditure, the following items were subtracted: local government expenditure; expenditure financed from the EU budget resources (EU funds, Recovery and Resilience Plan); co-financing expenditure from the state budget; transfers to the European Union budget; debt interest payments; one-off expenditures; as well as a part of expenditure on unemployment benefits affected by the economic cycle. These items have common characteristics in that the government has no direct control over them or they have been triggered by exceptional one-off circumstances.

In the second step, the Council determined the difference compared to the ceiling applicable for 2023 and, subsequently, considered the items listed by the legislation. These include the impacts of approved legislative changes on the revenue of the general government budget or the long-term sustainability, the effects of changes in the reclassification of certain entities into/from the general government sector, the effects of the so-called balance-neutral expenditures[3] and the impacts of using unspent funds from past years. Another category includes specifically defined revenues (e.g. revenue from grants or sales revenue) which are used for the financing of additional expenditure and their spending that exceeds the public expenditure ceiling is not legally considered as an overrun of the ceiling.

The evaluation concludes that the ceiling has been exceeded by nearly 1.0 bn euros (0.8% of GDP) primarily due to a permanent increase in expenditure associated with the 13th pension payments and the healthcare sector. Considering that the calculated ceiling for 2023 was expected to improve long-term sustainability by 0.2% of GDP, its actual result in 2023 contributed to the deterioration of long-term sustainability by approximately 0.6% of GDP.

Approved public expenditure ceiling for 2023

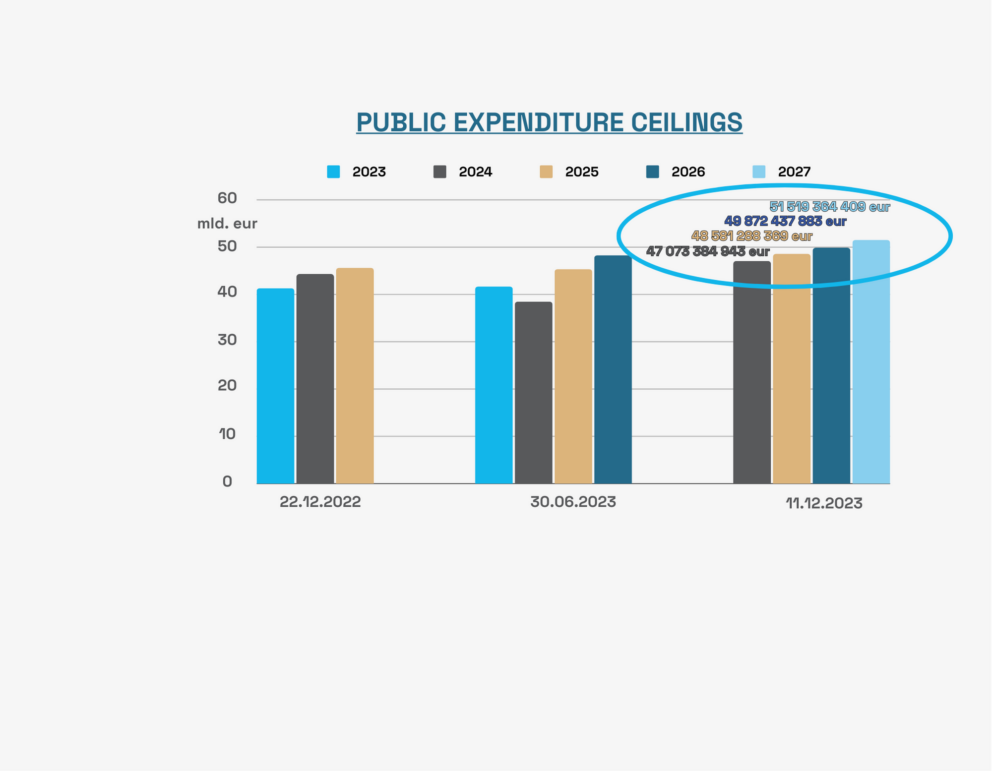

The CBR calculated the public expenditure ceiling for the period from 2023 to 2025 in December 2022 and subsequently submitted it to the parliament. The parliament approved the ceiling by Resolution No. 1964 of the National Council of the Slovak Republic of 1 February 2023[4]. The ceiling for 2023 amounted to 41,321,154,940 euros, and the approved budget complied with the ceiling.

Subsequently, within the legal deadline of 30 June 2023, the CBR prepared a regular update of the ceiling which reflected the impacts of legislative measures adopted between 1 January and 21 June 2023[5]. These involved legislative measures affecting the general government revenue or the long-term sustainability of public finances.

As the updated ceilings were only approved by the parliamentary committee for economic affairs and lacked the approval of the parliamentary committee for finance and budget, they did not enter into force. This means that the ceiling approved by Resolution No. 1964 of 1 February 2023 remains in force as the applicable ceiling. Hence, it serves as the baseline for the evaluation of compliance with the public expenditure ceiling. The impacts of legislative measures covered by the update were taken into account by the CBR in the evaluation of compliance with the ceiling[6].

Compliance with the public expenditure ceiling in 2023

Taking into account the difference between the applicable ceiling and the actual expenditure falling under the ceiling, while also considering the legislative measures (Table 1), the Council concludes that the government has exceeded the applicable public expenditure ceiling in 2023. The public expenditure ceiling has been exceeded by 994,389 thousand euros, i.e. by 0.8% of GDP.

Because the calculated ceiling for 2023 was expected to improve long-term sustainability by 0.2% of GDP[7], its actual result in 2023 contributed to the deterioration of long-term sustainability by approximately 0.6% of GDP[8].

The failure to comply with the public expenditure ceiling is primarily attributable to the introduction of permanent 13th pension payments (0.4% of GDP) and increased expenditure in the healthcare sector[9] in connection with wages and operating costs in hospitals (0.3% of GDP). Other factors include the approved changes regarding minimum pensions (0.1% of GDP) and higher expenditure of the Social Insurance Agency beyond the special indexation of pensions (0.1% of GDP). A detailed table is presented in Annex 2 (Table 10).