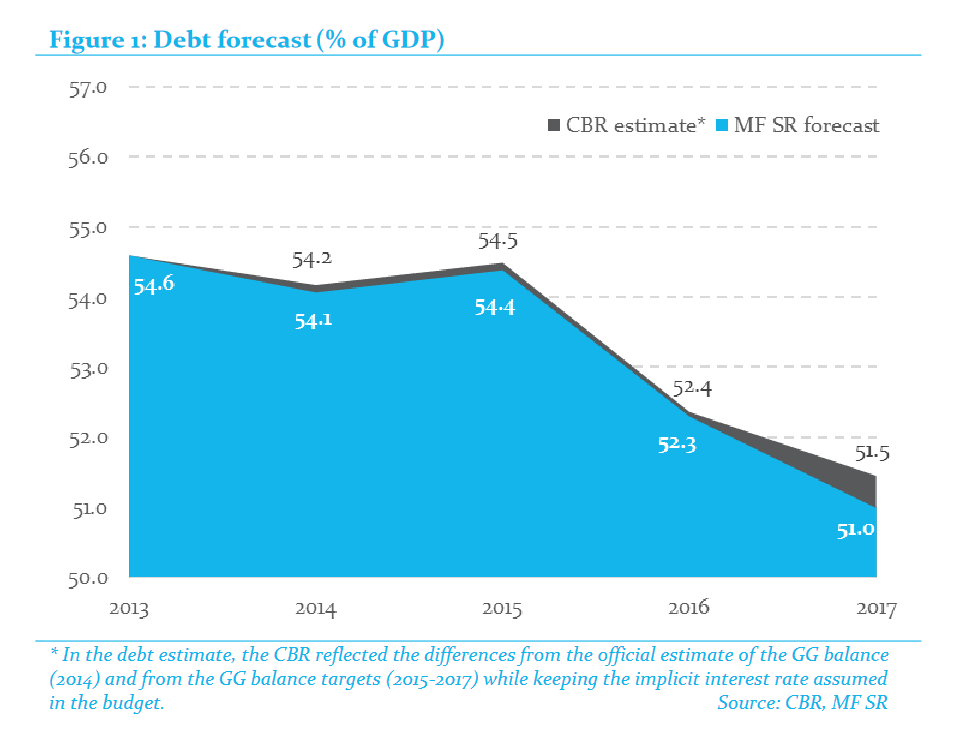

In its evaluation of the 2015-2017 budget proposal submitted by the government, the Council for Budget Responsibility (CBR) indicated that it would update it in the light of the changes introduced in the budget by the parliament.

Evaluation of the General Government Budget Proposal for 2015-2017 (November 2014)

- 12. 11. 2014